Press Release

Alternative Strategies Fund Celebrates 10-Year Anniversary with 5-Star Overall Morningstar Rating

We couldn’t find a core alternatives strategy that we liked, so we created our own. MORE

In creating the Alternative Strategies Fund, we sought to build a core, lower-risk alternatives fund that would hold up well in equity bear markets and exhibit relatively low correlation and beta to stocks and core bonds (recognizing that those would change as market conditions varied). There are several things we focus on, but risk-adjusted performance is a primary one. However, we still wanted the fund to deliver solid long-term absolute performance, since an investment with a high Sharpe ratio but very low actual return is difficult for most investors to hold over the long term.

These goals naturally have some tension between them, but we try to strike an appropriate balance through portfolio construction as well as partnering with talented, experienced sub-advisors and giving them significant flexibility within their mandates. This flexibility allows each manager to position their portfolios more offensively or defensively, depending on their assessment of the attractiveness of their investment opportunity set.

Our managers have successfully executed this “risk-averse-yet-opportunistic” philosophy over the past 10 years, frequently adding value by increasing exposure when credit and/or merger spreads widened significantly or pockets of value emerged in different asset classes or sub-sectors due to market overreactions to events, while maintaining more conservative exposures when markets offer less value. We think this is a key feature that has enabled the fund to be robust and resilient across myriad economic and market environments. And because strong risk awareness is fundamental to their investment approaches the benefits don’t depend on successfully making broad-based macro calls that can be difficult to repeat consistently.

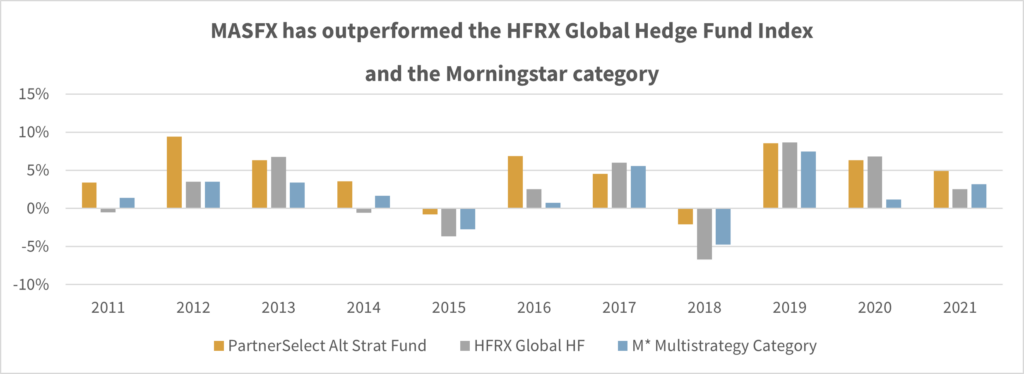

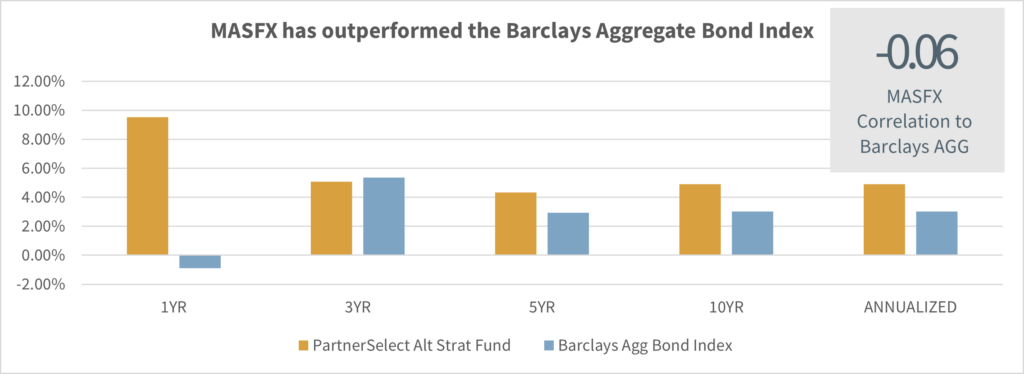

Overall, we’re pleased. We finished our first 10 years with a Morningstar 5 star Overall RatingTM. The fund’s volatility was at the low end of the range we targeted. Absolute returns were healthy at 4.90%. Our stock market beta was low at 0.28 and our correlation to the bond market was slightly negative at -0.06, which we believe makes it a powerful diversifier of core bonds and could be valuable in building portfolios in such a low-rate environment.

Past performance does not guarantee future results. Index performance is not illustrative of fund performance. An investment cannot be made directly in an index. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. To obtain the performance of the funds as of the most recently completed calendar month, please visit www.imgpfunds.com.

The only metric for which we didn’t at least meet our goals was the fund’s correlation to stocks, which came in at about 0.8. But we explicitly stated at the time of the fund’s launch that we expected the correlation to vary over time (given our managers’ opportunistic approaches) and at times come in above our target level. The fact that U.S. stocks have had an extended stretch of unusually consistent positive returns during this period goes a long way toward explaining the higher correlation. It is worth noting that the fund’s correlation and beta to stocks was lower in down market periods, which is ideally what we want.

We were mildly (but pleasantly) surprised by the fund’s slightly negative correlation to bonds. That was probably a big surprise to some investors who assumed the fund would have a higher correlation since two of our original (and three current) sub-advisors operate largely or exclusively in the fixed-income markets. However, their underlying strategies are flexible and quite different than core bond exposure, which is largely driven by sensitivity to interest rate movements.

Our sub-advisors vary and closely manage the credit risk they take, their portfolio duration (interest rate risk), and other return drivers (e.g., currency risk, yield-curve positioning, etc.). They may also invest in less-efficient or niche fixed-income segments that are not represented in traditional bond indexes. We expect their performance to be quite different than the investment-grade bond market, which has proven to be the case, and is attractive to many of our investors who use the fund to a significant degree as a diversifier for their core bond exposure.

A less pleasant surprise was the drawdown the fund lived through in mid- to late March 2020. The fund’s sub-advisors were positioned conservatively coming into the year. As such, we expected the fund to hold up extremely well in a bear market relative to stocks, as it has historically.

The fund still declined much less than the equity markets in the last two weeks of March, but relative performance wasn’t as strong as we would have expected due primarily to the near-total shutdown of credit markets that caused significant, but short-term, price dislocations in some assets the fund held that were subject to forced selling by leveraged investors (not our managers).

Despite this, we were pleased the fund weathered this extreme stress test, our managers largely maintained or increased their exposures at very attractive prices/spreads, and the fund bounced back sharply as prices normalized, generating strong absolute performance for the full year.

Of course, we would always like to perform well relative to all mainstream asset classes. But that isn’t realistic when stocks are up sharply. When we launched the fund, we warned that very-high-return periods for stocks would be a challenge for relative performance, especially compared to benchmarks that include meaningful stock exposure. Ten years later, the Russell 1000 Index is up approximately 17% annualized, a decade of staggering performance. Since our fund is designed to have a relatively low equity beta and its sub-advisors are heavily focused on risk management, this was a very tough period to be measured against long-only U.S. stocks.

While the U.S. stock market is by most measures a very high-quality asset, our view is that it isn’t cheap, and in fact is probably somewhat overvalued. It was inflated by ultra-low interest rates rather than strong fundamentals for part of the last decade, and then more recently has combined stronger fundamentals with those still low rates to rocket back up to new heights following the traumatic but brief drop in March 2020. At best, from current record-high absolute valuation levels, we see low odds of further valuation expansion for the U.S. stock market over the next five to 10 years. And we think a more likely scenario is one of valuation compression (likely coinciding with rising interest rates).

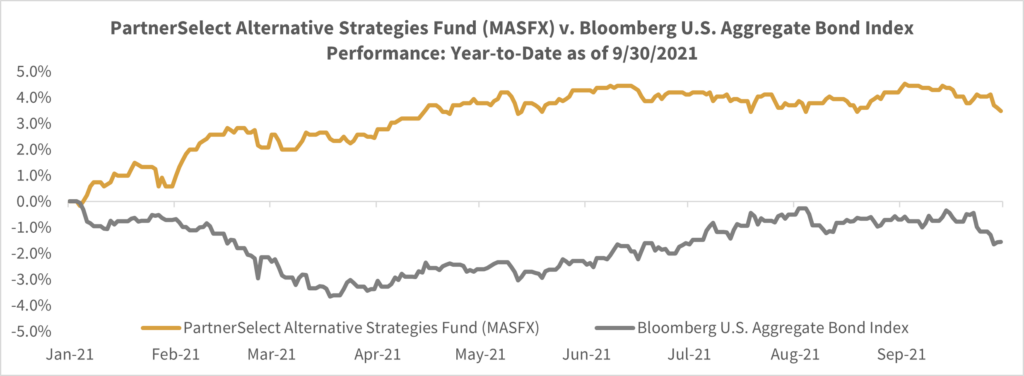

On the fixed-income side, trillions of dollars of global government bonds trade with negative yields, and of those with positive yields, trillions more trade below yields of 1% out to 10-year maturities. U.S. investment-grade corporate bonds have returned around 5% annualized for both the last five and 10 years, juiced by the same low rates that have helped propel U.S. equities to record levels. But core bonds now yield roughly 2% with significant duration risk. These levels seem unsustainable over the long run, but we don’t know when they will change. (Even if the current very low bond yields are maintained, that implies only around a 2% annual return, far below the past decade’s return.)

Since our managers have a risk-averse mindset, they won’t pile into markets they believe to be offering poor risk-adjusted returns, which describes much of the traditional asset universe for large parts of the fund’s life.

The bottom line is we believe our managers have stayed true to the risk-management focus of this fund, increasing exposure during periods of dislocation for certain asset classes or market segments, but remaining conservative when opportunities aren’t compelling. In hindsight, being more consistently aggressive since inception would have produced higher returns, but we don’t believe it would have been consistent with the fund’s objective.

Again, we don’t know when things will revert closer to “normal” in terms of rates, spreads, and valuations, but we do believe what Herb Stein famously said, “If something cannot go on forever, it will stop.” We expect the fund will look better compared to traditional asset benchmarks during more “normal” market conditions, whenever they return, and in the meantime will take advantage of opportunities the markets offer to generate decent to good absolute returns with relatively low risk.

It hasn’t changed. We still view it as a core, all-weather fund, appropriate for part or all of the alternatives exposure in a diversified portfolio. And we think a reasonable rule of thumb for funding the position can be 20% from stocks and 80% from bonds. As noted above, it has been challenging to compete against such a stock/bond blend over the past five and 10 years because of extremely high U.S. stock returns. But looking forward, with bond yields even lower than they were five years ago, and stocks not a bargain either, we believe the fund is very well positioned to add value.

We believe our fund will, at times, outperform bonds when stocks are weak, and we believe long-term returns should stack up very well versus bonds, as they have historically. But we also would reiterate that in recessionary bear markets, we believe core bonds still offer important diversification value (albeit less so than in the past), despite their very low current yields.

We believe including high-quality alternatives in a portfolio’s asset allocation can add meaningful value.

Fund investors have a wide range of asset classes and strategies at their disposal to build a well-diversified portfolio. Whether an investor includes alternatives in their portfolio should depend on the quality and the approach of the fund and the likelihood of it improving the risk-adjusted performance of the overall portfolio.

We do believe there are highly skilled managers in the alternatives world. If they can be accessed at a reasonable fee and combined in a way that can smooth out performance, they can improve a portfolio’s risk-adjusted returns. Additionally, when markets are expensive or volatile, they can serve an important role as ballast for portfolios.

Doing all those things is a challenge, and the approach we took in building our fund was to address each key component of success. Going forward, there are plenty of reasons to look beyond the standard asset classes given extremely low bond yields and what we believe is a richly valued U.S. stock market. In this context, we believe select alternative strategies, including our fund, are very well positioned to add value to a diversified portfolio.

We’ve added two sub-advisors since our launch and removed one, leaving us with the current five on the fund. It was never our intention to build a fund with 10 to 20 managers, as we think there are diminishing marginal returns and we can achieve appropriate diversification with a relatively concentrated portfolio of managers running complementary strategies.

We also don’t feel the need to check every box on the list of alternative strategies one could think of, but would rather give managers we trust fairly wide latitude within their investment programs.

However, we’ve always been interested in looking at new managers and strategies for potential inclusion, and over time, it’s likely we will gradually bring on additional managers. Over the last several years, we have conducted a couple intensive research projects on similar sets of managers/strategies that seemed promising, as well as reviewing many managers on a one-off basis at varying levels of diligence. For different reasons we haven’t yet added any from either group, but it’s still possible one or more may ultimately make it into the portfolio.

Regardless of strategy, any manager we add must meet our very high standards and be additive to the overall portfolio. (From a very high level, the strategies we have looked at most closely have been diversifying to equity market beta and also had low correlation to other strategies currently in the fund.)

Importantly, any manager we add also needs to be willing to work for a reasonable fee so we can keep overall fund expenses at a very competitive level. (We should note that we successfully worked with our sub-advisors over the last few years to reduce fees on the fund.) We don’t feel an urgent need to add any particular strategy to the fund, but we are always looking for the opportunity to improve it.

It is a challenging category for several reasons we outlined when we launched our fund a decade ago, and most of those remain true to varying degrees. We noted back then that fees were often egregiously high, the quality of the managers was frequently questionable, strategies were sometimes not understandable or well explained, and portfolio construction and risk management for multi-strategy and multimanager funds often seemed driven by marketing rather than by investment strategy. The result was largely mediocre-to-poor performance and investor frustration.

The space has changed in a few important ways, due in part to the unfulfilled promise of much of the liquid alternatives universe. First, the quality of managers and sub-advisors has generally improved, both due to the entry of new managers into the space (which admittedly happened more when asset flows to liquid alternatives were stronger) as well as the attrition of lower-quality, sub-scale, or otherwise unsuccessful managers. Second, fees have generally come down across the landscape. They are still higher than fees for traditional strategies, and we don’t expect that to ever change. However, for the best funds and managers, the fees are often reasonable given the specialized nature of alternative strategies. These developments are unquestionably positive for investors.

A final change we will mention is that the universe seems to have shifted toward more specialized strategies compared to the early years, as more investors and advisors seek to precisely target their exposures to different sub-strategies. We view this as neither a definitive positive or negative; for some, more specialized choices can absolutely be helpful in meeting specific portfolio objectives (e.g., a trend-following fund is likely to be more useful to protecting against an extended equity bear market than a long-short equity fund). However, the “paradox of choice” can easily come into play when there are too many seemingly reasonable options on the menu of alternatives.

Additionally, the more specialized options there are, the more tempting it is for investors to chase the ones that have delivered the best recent results, which can be just as dangerous in alternatives as it is in traditional strategies. Not surprisingly, we think multi-strategy funds can be a valuable part of an investor’s portfolio, whether held as the sole alternative position, the core of a core-satellite alternative allocation approach, or as we often see, as a replacement for a portion of an investors’ fixed-income allocation.

What hasn’t changed yet is the dominant and almost certainly unsustainable run of incredibly strong returns of a traditional 60/40 portfolio since the Great Financial Crisis, despite a handful of speedbumps along the way for both stocks and core bonds. This phenomenon has made most alternatives, whether liquid or private, look pointless (to overstate the case). While some well-constructed alternative funds have demonstrated superior risk-adjusted returns and/or diversification benefits, the overall positive direction and magnitude of traditional stock/bond portfolio returns has largely overshadowed the benefits. We believe that at some point traditional assets will experience more than a short-lived bump in the road and alternative strategies will prove to be sustained valuable components of a well-diversified portfolio.

On a related note, another unchanged aspect of the investment landscape is ultra-low short-term interest rates. The losses in core bonds in Q1 2021 reminded investors that when rates rise, these safe-haven assets aren’t as safe as they used to be, and can actually be a source of risk. Some alternative strategies may be good diversifiers for this underappreciated risk in traditional bond portfolios. Regardless of the specific role in a portfolio, the challenge for investors remains to identify funds that charge reasonable fees, provide access to highly skilled managers, and use sensible portfolio construction to deliver practical benefits to investors’ overall portfolios.

We created this fund because we couldn’t find high-quality options in the marketplace. Fees were too high and management quality was often mediocre. And there was another problem. We felt that marketing considerations were coming before investment considerations in the structuring of many funds. Funds were being designed with a veneer of sophistication and complexity to seem sexier and smarter, and managers were touting “bells and whistles” that we didn’t believe were materially additive to overall quality.

We believed the most reliable way to build a successful fund was to combine skilled and complementary managers, give them flexibility (with appropriate oversight), and keep fees reasonable. We focused on the desired investment outcome, believing that if we could achieve a good result for fellow investors, eventually marketing would take care of itself.

Part of that focus was to identify managers who we believe have a risk-averse mindset and take risk management very seriously (they know how to play defense), but who are also willing to opportunistically become more offensive-minded when the reward-to-risk ratio is particularly compelling. If done well, we believe this approach, combined with somewhat more systematic strategies for capturing “alternative risk premia” (e.g., merger arbitrage), is a way to generate good returns over the long run while also protecting against large drawdowns.

One thing we didn’t actively seek out was highly complex strategies just for the sake of having them. In the early days, our fund was sometimes criticized for not being “alternative enough.” But with 10 years behind us, the fund’s absolute performance has been good, while suffering dramatically smaller drawdowns than equity markets and effectively diversifying (and outperforming) core bonds — in line with what we believe investors are looking for in an alternatives fund.

We believe this approach will continue to work well and that the coming years could be a better environment for the fund relative to traditional asset classes. However, we want to be clear that our fund is not intended as an explicit hedge for equity risk. While those types of funds exist and can be useful, we have found that they tend to be challenging for investors to hold for extended periods when they’re not working. Thus, we stick to our approach while trying to build in more diversification over time as we add new managers and strategies.

The continued investment success of the fund is extremely important to iM Global Partner and we are focused on maintaining and building on its positive results so far. Our confidence in the fund is reflected in the sizable investments from the fund’s portfolio managers and iM Global Partner employees.

We couldn’t find a core alternatives strategy that we liked, so we created our own. MORE

Join us on November 4th for a discussion on the market environment. MORE

iMGP Funds emails provide investors a way to stay in touch with us and receive information regarding the funds and investment principles in general. Topics may include updates on the funds and managers, further insights into our investment team’s processes, and commentary on various aspects of investing.

Past performance is no guarantee of future results.

The fund’s investment objectives, risks, charges, and expenses must be considered carefully before investing. The statutory and summary prospectus contains this and other important information about the investment company, and it may be obtained by calling 1-800-960-0188. Read it carefully before investing.

Although the managers actively manage risk to reduce portfolio volatility, there is no guarantee that the fund will always maintain its targeted risk level, especially over shorter time periods and loss of principal is possible. The performance goals are not guaranteed, are subject to change, and should not be considered a predictor of investment return. All investments involve the risk of loss and no measure of performance is guaranteed. The fund aims to deliver its return over a full market cycle, which is likely to include periods of both up and down markets.

Mutual fund investing involves risk. Principal loss is possible.

Though not an international fund, the fund may invest in foreign securities. Investing in foreign securities exposes investors to economic, political and market risks, and fluctuations in foreign currencies. Investments in debt securities typically decrease when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in mortgage-backed securities include additional risks that investor should be aware of including credit risk, prepayment risk, possible illiquidity, and default, as well as increased susceptibility to adverse economic developments. Investments in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher-rated securities. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management, and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. The fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. Multi-investment management styles may lead to higher transaction expenses compared to single investment management styles. Outcomes depend on the skill of the sub-advisors and advisor and the allocation of assets amongst them. Merger arbitrage investments risk loss if a proposed reorganization in which the fund invests is renegotiated or terminated.

Diversification does not assure a profit nor protect against loss in a declining market.

Leverage may cause the effect of an increase or decrease in the value of the portfolio securities to be magnified and the fund to be more volatile than if leverage was not used.

Click here for Index Definitions | Industry Terms and Definitions

You cannot invest directly in an index.

The Fund’s Sharpe ratio ranked 1 out of 47 in its Peer Group, US OE Mulitstrategy Morningstar Category from 10/1/2011 to 9/30/2021. Past performance is no guarantee of future results. Sharpe ratio is measure of a fund’s return relative to its risk. The Sharpe ratio uses standard deviation to measure a fund’s risk-adjusted returns. The higher a fund’s Sharpe ratio, the better a fund’s returns have been relative to the risk it has taken on. Because it uses standard deviation, the Sharpe ratio can be used to compare risk-adjusted returns across all fund categories.

Each Morningstar Category Average represents a universe of Funds with similar investment objectives. As of September 30, 2021, the Morningstar Multistrategy Category average expenses were 2.64% gross and 1.83% net.

The Morningstar Rating for funds, or “star rating”, is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed products monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five, and 10-year (if applicable) Morningstar Rating metrics. The weights are 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10 year overall rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods. iMGP Alternative Strategies Fund was rated against the following numbers of Multistrategy funds over the following time periods as of 9/30/2021: 127 funds in the last three years, 101 funds in the last five years, and 35 funds in the last 10 years. With respect to these Multistrategy funds, iMGP Alternative Strategies (MASFX) received a Morningstar Rating of 4 stars, 4 stars, and 5 stars for the three-, five-, and ten-year periods, respectively. Ratings for other share classes may be different. Morningstar rating is for the Institutional share class only; other classes may have different performance characteristics. The Investor share class received a rating of 4 stars, 4 stars, and 5 stars for the three-, five-, and ten-year periods, respectively. ©2021 Morningstar Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

iM Global Partner Fund Management, LLC, has ultimate responsibility for the performance of the iMGP Funds due to its responsibility to oversee the funds’ investment managers and recommend their hiring, termination, and replacement.