Portfolio Commentary

During the quarter, the iMGP Dolan McEniry Corporate Bond Fund had a return of +0.54% versus the Bloomberg U.S. Intermediate Credit benchmark return of -0.26%.

Performance quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the funds may be lower or higher than the performance quoted. Short term performance is not a good indication of the fund’s future performance and should not be the sole basis for investing in the fund.To obtain standardized performance of the funds, and performance as of the most recently completed calendar month, please visit www.imgpfunds.com. There are contractual fee waivers in effect through 4/30/2024. In the absence of such waivers, total return would be reduced.

Market Review

During the second quarter, mixed returns were seen in fixed- income and equity markets. Despite rising interest rates, data continues to indicate a strong economy. In addition, inflation has cooled since last summer but remains elevated relative to the central bank’s target rate of 2.00%.

The Federal Reserve increased the Federal Funds Rate +0.25% to a benchmark rate between 5.00% and 5.25% in May. However, the Federal Reserve refrained from raising rates in their June meeting for the first time since they began raising rates in 2022.

During the quarter, treasury rates increased, and the curve remained inverted as the 10-year U.S. Treasury yield increased from 3.47% to 3.84%, the 5-year yield increased from 3.58% to 4.16% and the 2-year yield increased from 4.03% to 4.90%.

Per Bloomberg data, spreads of corporate investment grade bonds tightened 15 basis points during the quarter to an average option adjusted spread (“OAS”) of +123 basis points. The OAS of the Bloomberg Corporate High Yield Index tightened 65 basis points to +390 basis points at quarter end.

Outlook and Strategy

Dolan McEniry believes that client portfolios are positioned to provide reasonable absolute and relative returns going forward. Dolan McEniry’s core competence is credit analysis, and we focus on a company’s ability to generate generous amounts of free cash flow over time in relation to its indebtedness. Investment safety and risk mitigation are of primary importance as we continue to search for undervalued fixed income securities. As of June 30th, the iMGP Dolan McEniry Corporate Bond Fund had a +53 basis point yield premium and similar duration versus the Bloomberg U.S Intermediate Credit.

Performance and Stats

| 6/30/23 Stats | iM Dolan McEniry Corporate Bond Fund | Bloomberg U.S. Intermediate Credit |

| Yield to Worst | 5.92% | 5.39% |

| Yield to Maturity | 5.92% | 5.39% |

| Effective Duration | 3.41 years | 4.02 years |

| Average Coupon | 4.23% | 3.44% |

Attribution Commentary

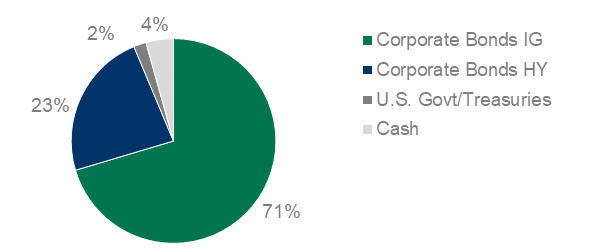

During the quarter, the iMGP Dolan McEniry Corporate Bond Fund outperformed the Bloomberg U.S. Credit Intermediate Index by 80 basis points. The Fund’s outperformance was driven by security selection in the corporate investment grade and high yield sectors. The yield curve positioning and duration had a minimal effect on the performance versus the benchmark.

Security Selection

| Top Performers | Bottom Performers |

| Qurate Retail Inc. | Newell Brands Inc. |

| DaVita Inc. | Dollar Tree Inc. |

| Tenet Healthcare | Verizon Communications Inc. |