| Manager Information | |

| Firm | Dynamic Beta investments (DBi) |

| Managers | Andrew Beer, Mathias Mamou-Mani |

| Website | www.dynamicbeta.com |

Executive Summary

Effective September 30th 2022, iM Global Partner has hired Dynamic Beta investments (DBi) as a sub-advisor to the iMGP Alternative Strategies Fund [MASFX]. DBi will be managing an Enhanced Trend strategy for the fund.

DBi is a New York-based, alternative investment manager with expertise across several hedge fund replication strategies including managed futures, equity long/short and multi-strategy. In addition to managing this mandate for MASFX, the firm is engaged as a sub-advisor by SEI Investment Management and manages two unique ETFs [DBMF, DBEH].

- In adding the DBi strategy, we seek to lower correlation to traditional assets and reduce the size of drawdowns while retaining the fund’s traditional focus on being opportunistic and delivering long-term attractive performance.

- DBi is a specialist in hedge fund “replication.”

- The core premise is that DBi can accurately replicate the beta exposures of a pool of hedge funds – and thus closely replicate the aggregate returns – using a relatively simple, elegant returns-based model to determine the exposures and implement them inexpensively using liquid futures contracts.

- DBi seeks to outperform the pool of funds it replicates by generating comparable returns at significantly lower cost, and at the same time eliminate single-manager risk.

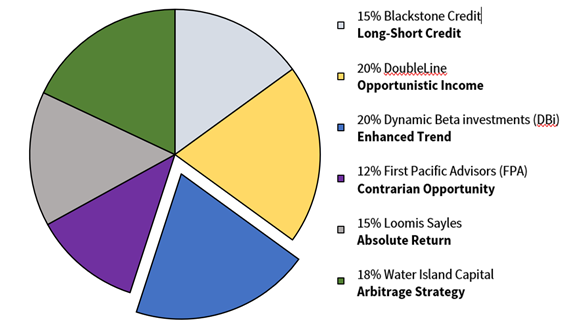

The iMGP Alternative Strategies Fund is a core alternatives fund that provides access to the distinctive investment strategies of a group of highly skilled managers. DBi joins five existing sub-advisor teams on the fund: DoubleLine Capital, First Pacific Advisors, Loomis Sayles, Blackstone Credit – Systematic Group (fka DCI), and Water Island Capital.

The new asset allocation will be as follows:

The DBi addition will result in an expense ratio decrease of approximately 3 basis points.

Firm Information – Dynamic Beta investments (DBi)

The Firm was founded in July 2012 and currently (as of August 31st, 2022) manages over $1.5 billion across several hedge fund replication strategies, including Managed Futures, Multi-Strategy and Equity Long/Short. The firm is engaged as a sub-advisor for the SEI Global Master Fund-The SEI Liquid Alternative Fund and the iMGP Stable Return Fund. The firm also sub-advises two ETFs – iMGP DBi Managed Futures ETF and iMGP DBi Hedge Strategy ETF.

DBi is a registered investment adviser with the SEC, is registered with the CFTC and with the National Futures Association as a commodity pool operator and commodity trading advisor.

Portfolio Managers

Andrew Beer, Founder, Managing Member and Co-Portfolio Manager

Andrew Beer is the founder and a Managing Member of DBi where he serves as Co-Portfolio Manager of the firm’s hedge fund replication investment strategies. Beer has been in the hedge fund business since 1994, when he joined the Baupost Group, Inc., one of the world’s premier hedge fund firms. In 2003, Beer was a co-founder of and, through a family investment company, the lead initial investor in Pinnacle Asset Management and related entities, a leading commodity investment firm. He was also a founder of Apex Capital Management, one of the earliest hedge funds focused on the Greater China region.

Beer is a frequent speaker on hedge fund investment strategies and industry dynamics and is an active contributor to various industry publications. Beer formerly was a member of the Board of Directors of the US Fund for UNICEF. He received his Master of Business Administration degree, as a Baker Scholar, from Harvard Business School and his Bachelor of Arts degree, magna cum laude, from Harvard College.

Mathias Mamou-Mani, Managing Member, Co-Portfolio Manager

Mathias Mamou-Mani is a Managing Member at Dynamic Beta Investments where he holds the

position of Head of Risk, Co-Portfolio Manager and Member of the Managing Board. He joined DBI’s predecessor company in 2008 and initially focused on exploratory data analysis and testing various statistical approaches for the replication programs.

From 2001 to 2006, Mamou-Mani worked as an IT Consultant/Project manager to develop complex IT systems for the French Ministry of Defense, France Telecom and Lafarge. He also founded GMB1 an internet company specialized in the sports industry.

Mamou-Mani holds a Master of Business Administration from the NYU Stern School of Business, with a specialization in Quantitative Finance, and Bachelor of Science and Master of Science degrees from the University of Paris Dauphine, France.

iMSquare Holding LLC (an iM Global Partner affiliate) owns a non-controlling stake in DBi. iM Global Partner also owns iMGP Fund Management, the Advisor to the iMGP Alternative Strategies Fund. Decisions to add or remove managers are made by the fund’s Portfolio Managers and approved by the Board of Trustees based on what is believed to be in the best interest of shareholders.

Overview and Background

The Alternative Strategies Fund (“MASFX” or “the fund”) has produced good long-term performance with low volatility, although it has experienced a challenging stretch of performance in 2022 (approximately -7.2% YTD through August 31).

Performance quoted is for the Institutional share class, represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Other share classes may impose other fees. To obtain standardized performance of the funds, and performance as of the most recently completed calendar month, please visit www.imgpfunds.com.

Given the attractive attributes of the portfolio, we believe the fund may potentially generate strong performance going forward, as it has following other periods of difficult performance. Throughout the fund’s history, we have been willing to accept short-term volatility and moderate downside in exchange for higher medium- to long-term returns, rather than create an ultra-low-risk portfolio that barely outperforms cash.

This philosophy has been largely successful, but one criticism of the fund has been its relatively high correlation with equity and credit markets, and in recent years, its somewhat larger-than-expected drawdowns during periods of market stress (specifically Q1 2020 and Q2 2022).

We have long recognized the potential benefit of adding diversifying strategies to the fund, and we have always been open to adding new managers to the original four subadvisors (DoubleLine, FPA, Loomis Sayles, and Water Island). We have added two managers since 9/30/2011 inception, with one subsequently removed (Passport).

DCI, the last manager added to the fund (in 2017), was added in part because we believed its return profile would be complementary to existing strategies in addition to attractive on a standalone basis. DCI has indeed been beneficial in terms of outperforming the overall fund significantly during stress periods, though it has been somewhat disappointing (producing low absolute returns) following the acute phase of pandemic-driven market stress.

After adding DCI, for the past several years we continued to focus our attention primarily on various diversifying strategies with very low/no correlation to equity markets and the other five strategies in the fund, but we did not feel the need to “force” an allocation to a strategy without high conviction, just to say we were adding diversification.

Some strategies we considered include: alternative risk premia, long-short currency, volatility arbitrage, multi-factor/multi-strategy managed futures, and several forms of systematic global macro. All of these strategies tend to be at least partially systematic and/or quantitative (“quant”) approaches, as compared to the more “discretionary qualitative” strategies run by FPA, Loomis Sayles, Water Island and DoubleLine. (Of course, all of those managers are highly analytical and use quantitative analysis and tools as part of their investment processes, but they are not quant- or algorithmic-driven investment approaches.)

Naturally, each type of systematic strategy has benefits and drawbacks. Those drawbacks typically included some combination of high fees, complexity, lack of scalability, high conditional correlation with equity markets during stress periods, and lack of a significant live track record. We proceeded relatively far down the road with several options over the last few years, including one that became more prominent in our consideration late last year into 2022 due to several factors, including its attractive individual characteristics and highly complementary fit with the fund’s existing portfolio. As we continued our diligence on that firm and strategy, we concurrently began assessing whether a simpler, cheaper, customized DBi strategy could be a potentially better option.

Trend Following as a Core Component

We believed trend following should be a significant part of the strategy, given its attractive return profile of positive long term expected returns and a strong tendency to add value to more conventional strategies during market dislocations. Trend following (also known as “time series momentum”) has historically been highly complementary to traditional asset exposures, particularly equity risk. It has typically displayed strong performance during sustained equity market losses (“crisis alpha” or returns above what one would earn substituting cash for trend following during a market crisis). It tends to have positively skewed returns, low correlation to equities and core bonds over long periods, and smaller drawdowns than equities at a similar risk level. While it has no fundamentals (e.g., cash flows, yield) to anchor a valuation, it takes advantage of persistent human behavioral tendencies and institutional structural inefficiencies and has demonstrated significant positive returns over time in many studies and industry indexes1 (especially before fees).

Like any asset class or strategy, it does not work all the time and can go through extended periods of disappointing performance, but its return characteristics suggest that as a long-term strategic allocation, it can be a valuable part of a diversified portfolio, potentially increasing returns and decreasing volatility and drawdowns.

Why Does Trend Following Work?

There are a variety of explanations for why trend following works, both behavioral and structural. There are varying degrees of academic support for these reasons, but regardless of which explanations one finds most compelling, there is strong historical academic and practical evidence that time series momentum exists. Further, many of these causes are typically most pronounced during a market crisis, which helps explain the historically strong performance of trend following during equity market crises1 (since almost all investors have significant equity exposure at the core of their portfolio).

Explanations are often fall into two categories:

- Initial under-reaction to news/events/triggers:

- Anchoring

- Disposition effect (selling winners too early, holding losers)

- Non-profit-maximizing actors/activity (central banks, mechanical portfolio rebalancing)

- Slow moving capital and market friction

- Delayed over-reaction:

- Herding

- Confirmation bias

- Fund flows (return chasing by investors)

- Risk management activity (stop loss orders, corporate hedging of commodity costs/currency exposure)

Again, it is important to emphasize that no strategy works all the time (or it would likely be arbitraged away), and trend following is no different. Its returns do tend to be quite concentrated in certain months or quarters (typically associated with severe market stresses for stocks, especially, although not exclusively).

Intuition and several periods of significant positive returns during periods of severe market stress over the last decade lead us to believe that this “crisis alpha” is unlikely to dissipate any time soon. Even if, to be conservative, we assume that returns for the strategy between those very strong periods are lower than historical numbers indicate, the return profile of trend following still makes it a valuable piece of a portfolio.

DBi as a Potential Option

Our initial research involved comparing some combinations of the actual track records of the DBi-subadvised ETFs DBMF (managed futures) and DBEH (equity hedge) — tilted toward DBMF because of the superior diversification benefit — to the volatility-adjusted returns of the other strategy we were actively considering. The results were promising, showing performance better than our modeling of the other strategy’s adjusted returns. (Because the other manager would have to run their strategy at a lower volatility target than the comparable hedge fund to meet our fee requirements, performance would necessarily be lower than that of their flagship fund.) Further, the performance improvement in stress periods was roughly comparable for both strategies, with each adding significant value compared to the MASFX historical track record alone.

We then worked with DBi to create a customized implementation of the strategy that would be a strong fit for the fund. We looked at different combinations of the managed futures (MF) and equity hedge (EH) strategies, and at other potential modifications. We wanted a blend of MF and EH because while they are each attractive individually, they are quite complementary to one another and make a strong combination. MF are highly effective as a diversifier to traditional assets (stocks and bonds) but tend to have “lumpy” returns and can go through extended periods where performance is flat or choppy if there is a lack of significant investable trends. Adding an element of EH tends to smooth the performance of a pure MF strategy and provide a return enhancement during less “trendy” markets without sacrificing much of the attractive diversification benefits of MF (assuming an appropriate mix).

Ultimately, we wanted to ensure enough MF exposure to make a material difference in performance in a year like 2008 or 2022, but not be entirely exposed to MF given the potential for extended periods of drag and short periods of sharp reversals in trends that result in material monthly drawdowns. Adding EH also allowed us to capture some of the upside from successful hedge fund factor/geographic rotations (e.g., into growth stocks in 2020) where the fund has historically lagged somewhat compared to higher beta competitors.

Ultimately, we arrived at a blend of 75% MF and 25% EH, which we refer to as the “DBi Enhanced Trend strategy”. We analyzed several combinations but felt this was appropriately tilted toward MF without being overly optimized for the performance in any specific time period. Additionally, for the strategy’s MF allocation, DBi will replicate a diversified pool of trend followers rather than the more diversified pool of CTA managers that they replicate for the DBMF ETF. This effectively gives us more “bang for the buck,” as the Trend pool is a subset of the the broader CTA pool. The broader CTA pool includes funds that have allocations to other strategies such as mean reversion, carry, and discretionary macro. The two pools are highly correlated (>0.9), but, the Trend pool has somewhat higher volatility (and thus higher returns over the long term, though with the potential for sharper losses in periods of short-term reversals).

We also added risk controls to the combination. We looked at several options, and at varying levels of “tightness.” Because the strategy overall is very diversifying to the fund’s existing portfolio, the risk controls are relatively loose. The one very specific scenario against which we wished to guard was the case where trends have the strategy positioned very net long equity beta (i.e., positively exposed to equities) into a sharp equity market correction/downturn, since that would exacerbate what would already likely be losses in the rest of the fund from managers with significant equity and/or high yield exposure. We thus added a 0.5 equity beta cap to the strategy, which in the historical simulation was rarely triggered, but did make a significant impact in a handful of months. Most notably, entering February 2018, equity market trends were strongly positive, so trend followers were very long equity beta. The S&P 500 Index then fell almost 4% in February, dropping almost 9% intra-month, likely causing many MF funds to cut their positions and miss the rebound. Although this reduced the modeled returns modestly, we feel the tradeoff of sacrificing a bit of return in exchange for a significant reduction in risk is one worth making, given the fund’s mandate.

The final piece of the puzzle was arriving at a new weighting scheme for the different components of the fund. Our allocations are 20% each to DBi and DoubleLine, 18% to Water Island, 15% each to Loomis Sayles and DCI, and 12% to FPA. We arrived at these weights after reviewing several options ranging from almost pure equal weighting, to overweighting DBi based on its diversification benefits.

As usual, we used common sense guardrails and avoided over-optimization based on historical returns in an effort to make the portfolio robust across a variety of different market environments rather than heavily geared toward any specific set of conditions or implicitly assuming history will exactly repeat. Within that overall framework, we believed we should: make DBi and DoubleLine the largest allocations given their attractive combination of strong diversification (particularly DBi) and very good returns; keep FPA the smallest allocation given its high correlation to equity markets and relatively high volatility (FPA has also generated the highest returns historically); and make Water Island a slightly higher allocation than Loomis Sayles and DCI since Water Island has generated the most consistent returns since augmenting its risk management system over six years ago.

An additional shareholder benefit of this allocation is that we project the overall fund expenses (at current AUM) to decline by roughly three bps (0.03%) after adding DBi.

DBi’s Investment Philosophy and Strategy

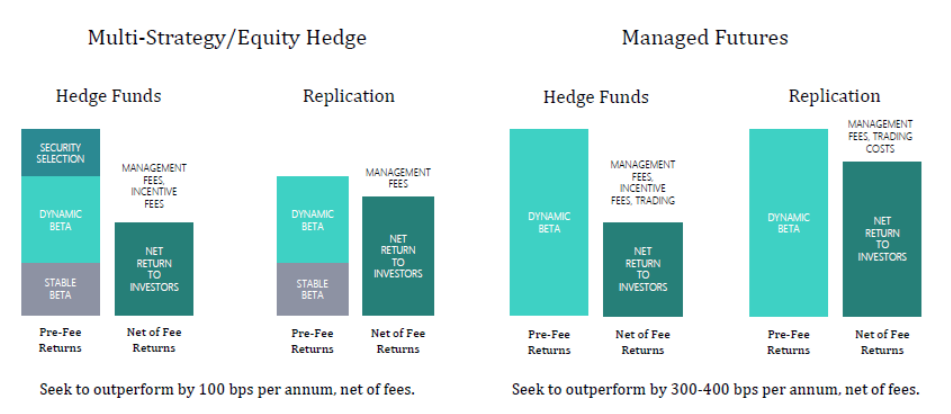

DBi believes hedge funds can add value to traditional portfolios on a pre-fee basis, but that ability is due largely to their flexibility to make sector, geographic, and/or style shifts. Although these are generally expressed through individual security selection (except in managed futures funds), the majority of returns can be explained by the shifts in beta exposures over time (hence the name “Dynamic Beta”).

Through a relatively simple returns-based model and liquid futures contracts on less than 20 assets/markets, DBi can very accurately replicate the beta exposures of a pool of hedge funds, and thus the great majority of the returns. Minimizing the fee and expense drag (“fee disintermediation”) allows the DBi strategies to deliver net returns to investors that are highly correlated to, but better than, the net returns of the target hedge fund groups.

The graphic below illustrates this concept, and also shows a key difference in the strategy as implemented in Managed Futures versus Equity Hedge . As mentioned parenthetically above, managed futures funds rely on macro-level exposures rather than security selection for the entirety of their return generation (excluding the return on collateral), meaning that the replication approach can theoretically capture the entirety of gross returns and thus deliver far superior net returns than the target pool of funds, due to the replication strategy’s much lower level of fees and expenses. Excellent equity hedge funds should add value (gross of fees) through security selection over time in addition to the evolving beta exposures, which the replication approach cannot capture. This results in less pre-fee return to harvest and less outperformance of the net returns of equity hedge funds compared to the managed futures funds.

However, the equity hedge strategy can still be a valuable addition to portfolios. For example, the DBEH ETF has delivered returns comparable to the S&P 500 and significantly better than the MSCI ACWI since its inception through August 2022 at lower risk (experiencing lower peak volatility and approximately 2/3 the drawdown of the S&P 500 and MSCI ACWI during the pandemic).

There are several steps in the process that are conceptually identical, although the implementation details vary by specific strategy (Equity Hedge or Managed Futures). They are:

- Creating the Target universe (the group of hedge funds whose returns will be replicated)

- For equity hedge, this consists of 40 of the largest long-short equity hedge funds (limited to one fund per firm to increase diversification).

- For managed futures, this consists of a group of the largest trend-following funds, a subset of the broader CTA universe.

- The Targets are equally weighted and rebalanced once per year in January based on the funds’ reported AUM as of the preceding September. (The decision to equally weight the funds in the equity hedge Target largely comes down to diversification – three or four funds can make up over 50% of that group if weighted by assets. This would largely counteract one of the benefits of replication: avoiding single fund “blow-up” risk.)

- Calculating the Target returns

- A critical element in the process that may be overlooked or underappreciated is the “grossing-up” (adding back incentive and management fees to each of the funds within the Target group based on their individual fee structures).This reduces the smoothing effect that incentive fees have on reported net performance, which allows DBi to model the return drivers more effectively/accurately. It also –obviously, but importantly— increases the returns the model is trying to replicate, which magnifies the benefit of DBi’s lower, flat fee structure relative to hedge funds.

- Replicating the Target returns

- DBi’s model is a multi-factor regression that uses the Target’s trailing returns to determine the set of beta factors (e.g. MSCI EAFE, gold, JPY/USD, 2Yr US Treasury) that would have most closely matched those returns. With some relatively minor constraints, the model constructs the portfolio using highly liquid futures contracts across equity indices, currencies, rates, and commodities to replicate these exposures.

- For EH, the model rebalances monthly. Underlying hedge fund performance is typically reported monthly and the positioning tends to shift relatively gradually.

- For MF, the model rebalances weekly. Performance of many trend following managers is typically reported daily and the exposures of the underlying funds tends to change more quickly than EH managers (depending on the prevailing trends in markets).

- The model has produced returns highly correlated to its Target groups, with rolling 3-year correlations in the 80% to 90% range for the composites.

Risk management is largely a function of replicating diversified portfolios with highly liquid instruments, but the process also incorporates a “post-processing” adjustment that can reduce exposures pro-rata if the volatility jumps because of market changes shortly after the portfolio is rebalanced. This isn’t uncommon but is typically fairly minor. Counterparty and credit risk is minimal since DBi trades in exchange-traded instruments only, which bear no counterparty risk. The exchange clearing house itself acts as the counterparty to both sides of the contract, the buyer and the seller. Also, positions are marked-to-market daily with required margins to be posted and always maintained.

DBi also monitors risk by analyzing the following metrics:

- Drawdowns

- Historical volatility of current positions

- VaR: simulation of recent historical price moves to compute expected loss at a specific confidence level

- Scenario Analysis: the worst one-day portfolio loss given all historical price moves

Conclusion

The DBi investment premise is simple and sensible. Although the execution obviously has some level of complexity, it is relatively straightforward compared to much of the quantitative universe. Through replication, DBi is able to avoid the “quantitative arms race” that has the potential to lead down rabbit holes of complexity, illiquidity, and data mining in an effort to build the best mousetrap.

DBI’s approach also avoids major risks associated with many hedge funds and even some liquid alternative strategies:

- Single manager “blow-up” risk. A category performing well while the selected single manager within that category performs poorly (particularly in what is supposed to be the most diversifying component of a fund/portfolio) is obviously an extremely bad outcome.

- Liquidity mismatch between assets and liabilities. Hedge funds have in the past imposed gates even in strategies that are theoretically liquid. On a few occasions, even daily liquidity mutual funds have suspended redemptions when their assets became illiquid or impossible to value accurately. Even when funds haven’t suspended redemptions, they have taken huge losses selling illiquid assets to raise cash to pay shareholders who are selling.

- Sharp drawdowns due to concentrated exposure to crowded long hedge fund positions (highly valued tech/growth stocks in late 2021 into 2022) subject to deleveraging, or to single-name shorts that could become “meme stocks” and explode to the upside.

Based on many factors, including their process, philosophy, historical performance, and our myriad conversations and interactions, we came away impressed with the DBi team and their approach. They are very experienced, with both quantitative finance/programming background and direct hedge fund/proprietary trading experience. We believe that knowing how both quantitative and fundamental hedge funds invest and the potential pitfalls involved is invaluable and has helped the firm avoid some mistakes common in many alternative strategies.

DBi’s ability to reliably approximate the performance of their target groups at significantly lower fees has resulted in fairly consistent outperformance that adds up significantly over time, and the performance of the strategies comprising Enhanced Trend is strong for their categories (especially on a risk-adjusted basis). DBi’s track record strongly suggests that the firm can continue to offer a highly liquid portfolio that captures the majority of the gross returns of the target groups of hedge funds with consistently high correlation to the target groups.

The Enhanced Trend strategy is very attractive on a standalone basis and brings a highly complementary return profile to the existing MASFX portfolio. All of these factors led to our decision to add the DBi Enhanced Trend strategy to the Alternative Strategies Fund.