Market Review

During the fourth quarter of 2021, U.S. Treasury rates rose, and the curve flattened as the short-end of the curve rose more significantly than the longer-end of the curve. Corporate investment grade spreads widened while high yield spreads tightened during the quarter. The combination of higher rates and little changed spreads led to mixed returns in many fixed income products. Despite the spread of the Delta variant of COVID-19, steadily improving economic and financial conditions, along with the continued backing of the Federal Reserve, has led to tighter spreads for the year.

Improving economic and financial performance over the last several months has increased consumer and investor confidence. As the Federal Reserve intended to accomplish, the economy has continued to recovery from the immediate effects of COVID-19. In the fourth quarter of the year, the Fed began to taper asset purchases and has indicated a desire to end such purchases and increase U.S. Treasury rates in 2022. Dolan McEniry will continue to monitor any changes for opportunities that may arise within credit markets.

During the quarter, the 10 year U.S. Treasury yield increased from 1.49% to 1.51%, the 5 year yield increased from 0.97% to 1.26%, and the 2 year yield increased from 0.28% to 0.74%. U.S. Treasury rates have increased from pandemic lows but remain low on a historical basis.

Per Bloomberg data, spreads on corporate investment grade bonds widened 8 basis point during the quarter to an average option adjusted spread (“OAS”) of +82 basis points. The OAS of the Bloomberg Corporate High Yield Index tightened 6 basis points to +283 basis points at quarter end.

Portfolio Commentary

During the quarter, the iM Dolan McEniry Corporate Bond Fund had a return of -0.81% versus the Bloomberg U.S. Intermediate Credit benchmark return of -0.55%.

On a relative basis, the iM Dolan McEniry Corporate Bond Fund underperformed the Bloomberg U.S. Credit Intermediate Index by 26 basis points. The fund’s underperformance was driven by the fund’s underperformance in corporate investment grade. The yield curve positioning and duration had a minimal effect on relative performance versus the benchmark.

Performance quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the funds may be lower or higher than the performance quoted. Short term performance is not a good indication of the fund’s future performance and should not be the sole basis for investing in the fund.To obtain standardized performance of the funds, and performance as of the most recently completed calendar month, please visit www.imgpfunds.com.

Outlook and Strategy

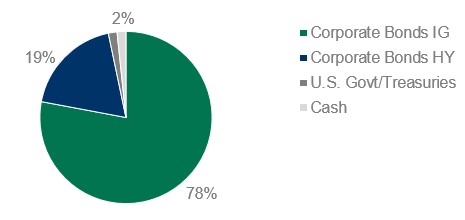

Dolan McEniry believes that client portfolios are positioned to provide reasonable absolute and relative returns going forward. Dolan McEniry’s core competence is credit analysis, and we focus on a company’s ability to generate generous amounts of free cash flow over time in relation to its indebtedness. Investment safety and risk mitigation are of primary importance as we continue to search for undervalued fixed income securities. As of December 31st, the iM Dolan McEniry Corporate Bond Fund had a +49 basis point yield premium and similar duration versus the Bloomberg U.S Intermediate Credit. We believe these stats will allow the portfolio to perform well versus the benchmarks over time.

| 12/31/21 Stats | iM Dolan McEniry Corporate Bond Fund | Bloomberg Intermediate Credit |

|---|---|---|

| Yield to Worst | 2.22% | 1.73% |

| Yield to Maturity | 2.52% | 1.77% |

| Effective Duration | 3.58 years | 4.37 years |

| Average Coupon | 4.10% | 2.93% |

Attribution Commentary

Yield Curve and Duration: The yield curve positioning and duration had a minimal effect on the performance versus the benchmark.

Commentary: During the quarter, the iM Dolan McEniry Corporate Bond Fund underperformed the Bloomberg U.S. Credit Intermediate Index by 26 basis points. The fund’s underperformance was driven by the fund’s underperformance in corporate investment grade

Security Selection

| Top Performers | Bottom Performers | |

|---|---|---|

| AMC Networks Inc | Oracle Corp. | |

| Lumen Technologies Inc. | Qorvo Inc | |

| Microchip Technology Inc. | Qurate Retail Inc. |