The iMGP Oldfield International Value Fund declined 15.24% during the third quarter of 2022, lagging its benchmark MSCI EAFE Value Index (loss of 10.21%), as well as the MSCI EAFE Index (loss of 9.36%). The Morningstar’s Foreign Large Value Fund peer group fell 11.27%. Since its inception November 30, 2020, the fund has fallen 8.67%, behind its value benchmark and peers which are down 4.80% and 5.32%, respectively. The MSCI EAFE Index has fallen 8.56% over the same period.

Performance quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the funds may be lower or higher than the performance quoted. Short term performance is not a good indication of the fund’s future performance and should not be the sole basis for investing in the fund.To obtain standardized performance of the funds, and performance as of the most recently completed calendar month, please visit www.imgpfunds.com. Returns less than one year are not annualized *There are contractual fee waivers in effect through 4/30/2023.

Quarterly Portfolio Manager Commentary

The first nine months of 2022 have proved very difficult for the fund due to the Russian invasion of Ukraine ordered by President Putin.

Markets reacted instantly with falls everywhere but with large asset flows out of Europe and into the US as a flight to safety. Investors were concerned about Europe’s reliance on Russian fossil fuels. We do not view the considerable near-term threats to gas supply in Europe to be an issue that should lower the long-term value of the portfolio holdings in Europe.

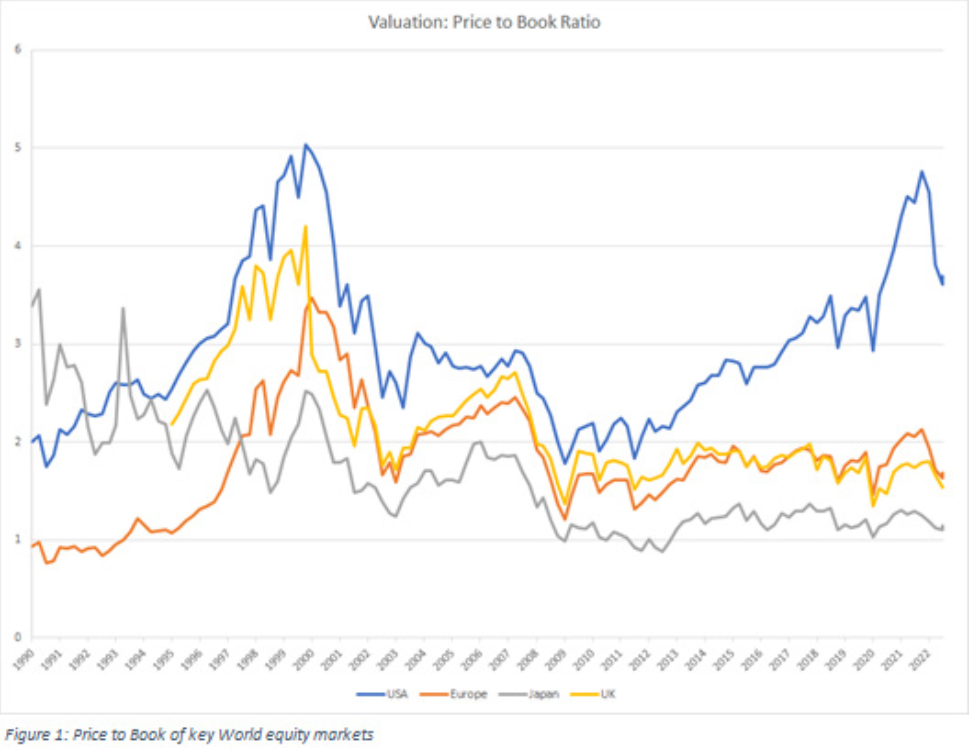

While the flight into the relative safety of the US is understandable as an emotional response, a calm appraisal of relative valuations tells a very different story. Valuation always matters and with so much discounted already in non-US markets the still historically expensive US market does not look like a safe haven to us.

The US dollar’s safe haven status as the world’s reserve currency has been supplemented by the faster rises in the US Federal Funds rate relative to other countries’ policy rates. This has pushed the dollar’s value up to levels of valuation against most other currencies seen only twice in half a century. The strength of the US dollar has therefore worsened the absolute falls of our international stocks in US dollar terms in this US dollar-based fund.

The fund’s 19% exposure to Japan has proved a relative bright spot so far this year where the fund’s stocks have delivered a positive return in Yen terms and a fall of just 7% in US dollar terms. This is largely due to the outstanding performance of Mitsubishi Heavy Industries (MHI), the industrial conglomerate that is the third largest supplier of gas turbines in the world but also a tier 1 supplier to Boeing, Japan’s largest defense contractor, and the leading Japanese nuclear power specialist that has been playing a central role in bringing Japan’s nuclear fleet of reactors back online. At the beginning of January, we sold the entire position in the utility, Kansai Electric Power, and added to the holding in MHI. After MHI’s strong performance we have reduced the holding in recent months, once in June to fund an increase in LG H&H, and again in September to fund increases in Sanofi and Siemens.

At the stock level, the largest negative contributors year-to-date were, in order of their impact on the fund’s relative return, easyJet (-56% total return in US dollar terms, -2.3% impact on the fund’s return relative to MSCI EAFE Value), BT (-39%, -2.0%), Samsung Electronics (-43%, -1.4%), Fresenius (-46%, -1.6%), E.On (-43%, -1.3%) and Siemens (-42%, -1.2%).

Two stocks have provided positive contributors year-to-date: Mitsubishi Heavy Industries (+48%, +1.5%) and Korea Tobacco & Ginseng (-5%, +0.1%).

September was a particularly poor month for world markets with the fund down 11.41%, lagging MSCI EAFE Value by 244 basis points. At a country level, the UK market was the biggest negative accounting for 1.8% of the differential, hurt particularly by the astonishingly inept “Fiscal Event” when the new Chancellor of the Exchequer published a massive but much trailed energy price subsidy but also the largest package of tax cuts in 50 years without any indication of how the latter would be paid for. This sent the bond and currency market reeling and led to the need for emergency intervention by the Bank of England in the bond market. This was needed to prevent UK pension funds from being forced into sales of bonds and equities to fund margin calls on the derivative packages used by many pension funds to help them match their liabilities and assets. As a result, three of the five largest negative contributors to performance in September were in the UK – BT (-23% in USD terms, -1.0% impact on the differential to MSCI EAFE Value), easyJet (-21%, -0.6%) and Tesco (-20%, -0.5%). The other large negatives were LG H&H (-17%, -0.5%) and Porsche SE (-21%, -0.4%). The positive contributors in the month that were also up in US dollar terms were Exor (+6%, +0.5%), Svenska Handelsbanken (+0.3%, +0.2).

One good indication of the value in Europe that is available today is Germany’s Volkswagen, of which 53% of its ordinary shares are owned by Porsche SE, the holding company of the founding families which is held in the portfolio. At the end of the month, VW sold a 25% stake in its Porsche car subsidiary that valued the subsidiary at €75bn. The IPO was heavily over-subscribed despite the negative sentiment surrounding the German equity market. The market value of VW ended the month valued at €75bn (or €63bn if one uses the lower share price of the heavily traded vote-less preference shares). This implies a ZERO value for the rest of VW that sells 8.5 million cars a year (excluding Porsche cars) including VW, Audi, Skoda, SEAT, Bentley, Lamborghini as well as Scania and MAN trucks! VW’s automotive business has net cash on its balance sheet of €12bn. Even if we assume a collapse in group margin from 8.5% to 4% in a recessionary environment the shares are already trading at 6.5 times these depressed earnings.

The reason for our optimism is that the shares held by the fund and especially those in the hardest hit areas of the UK, European and East Asian emerging markets are now historically cheap, and their currencies all look very undervalued against the US dollar. If the extremes of the last 50 years are any guide, then as Ben Inker of GMO explained in his recent letter, we now have two ways to win—historically cheap stocks and historically cheap currencies. The weighted average upside in the fund has rarely been higher at 65% on a two-year view and we can expect a gross dividend yield of 4% per annum too. The fund is valued at just nine times historic profit and just seven times profits expected over the next 12 months. The price to book ratio of the fund is below one. There is huge value in the shares held by the fund, and much is priced into non-US equity markets. The outlook for the patient and contrarian value investor is surprisingly bright.

Portfolio Allocations as of September 30, 2022

| By Region | Fund |

| Europe | 61.63% |

| North America | 0.00% |

| Asia ex-Japan | 16.14% |

| Japan | 18.59% |

| Latin America | 3.64% |

| Africa | 0.00% |

| Australia/New Zealand | 0.00% |

| Middle East | 0.00% |

| Other Countries | 0.00% |

| By Sector | Fund |

| Finance | 23.41% |

| Consumer Discretionary | 9.24% |

| Information Technology | 3.70% |

| Communication Services | 5.45% |

| Health Care & Pharmaceuticals | 14.99% |

| Industrials | 20.24% |

| Consumer Staples | 12.16% |

| Real Estate | 0.00% |

| Utilities | 3.49% |

| Energy | 4.74% |

| Materials | 0.0% |

| Cash | 2.58% |