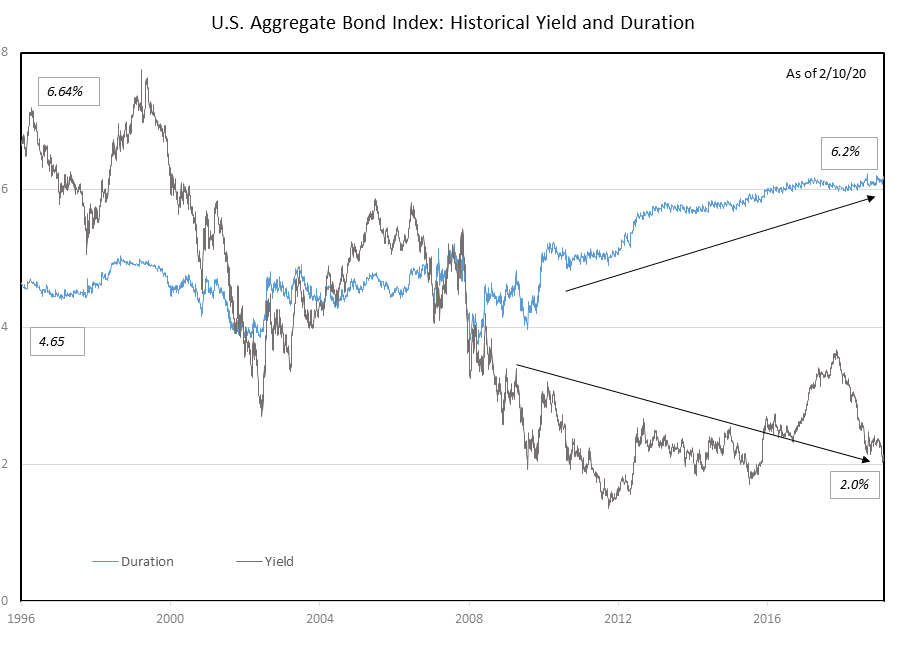

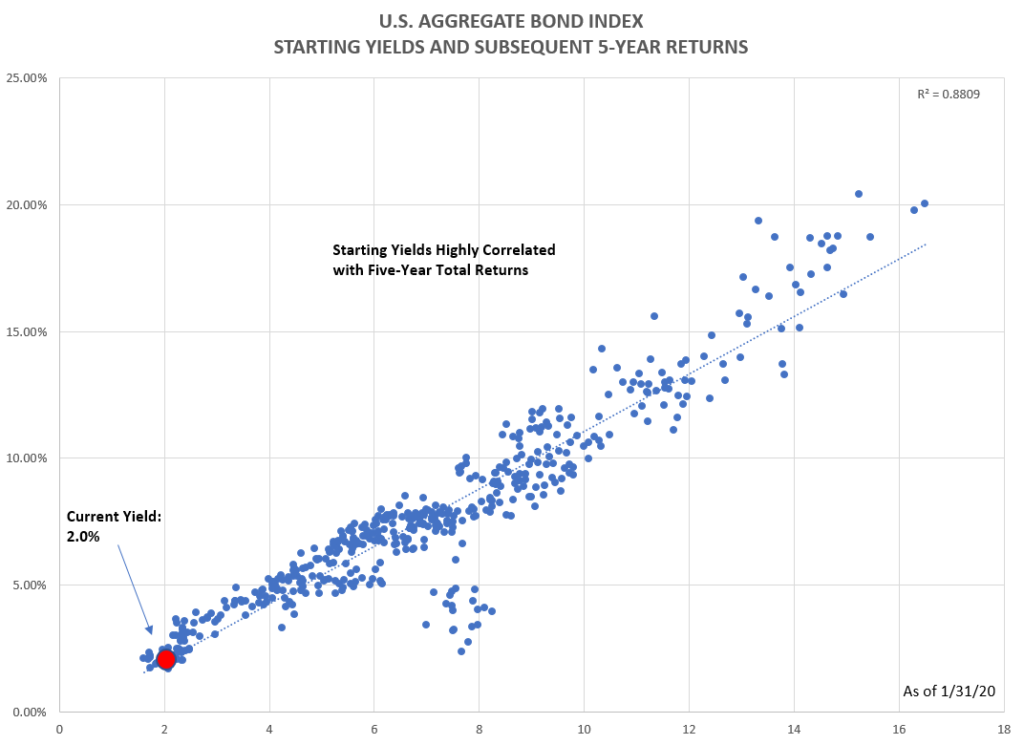

Core Bonds Have Low Yields and Long Duration

Core bonds have historically served as a ballast to equity exposure in a market decline. We think they will continue to serve this purpose, but the benefit will be subdued given today’s low starting yields. Should global growth pick-up, investors are taking on historically high levels of rate risk.

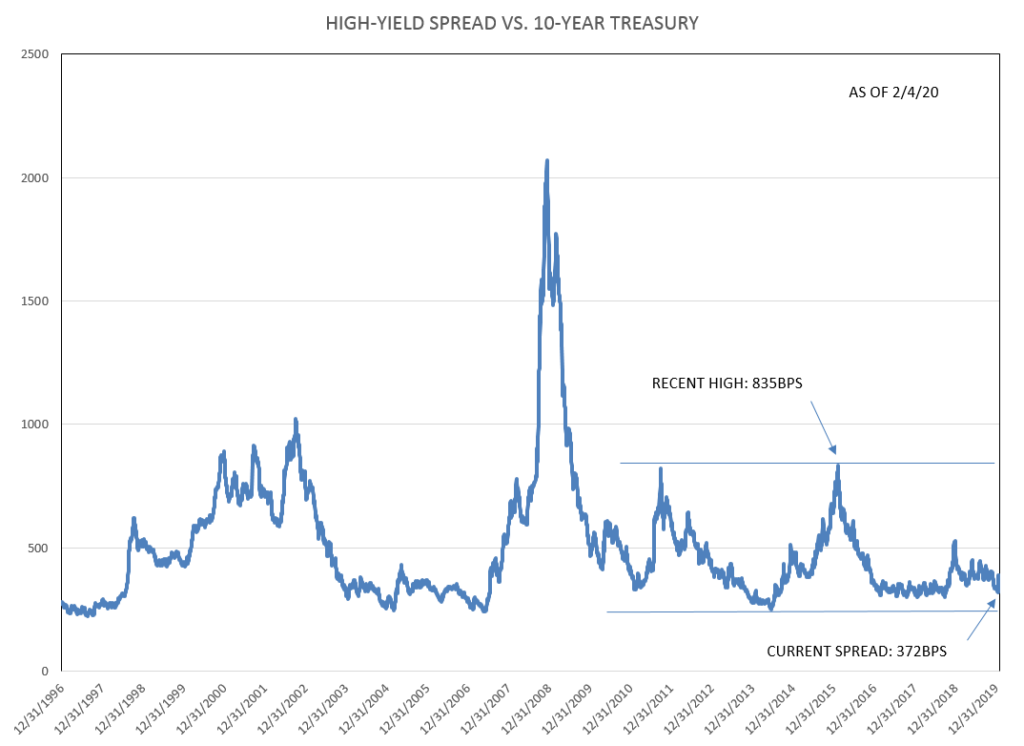

High-Yield Bonds

High-yield bonds performed extremely well in 2019 gaining 14.4%. At current valuation levels, we believe the upside is limited with asymmetric downside. The chart below illustrates the historical spreads relative to 10-year Treasuries.

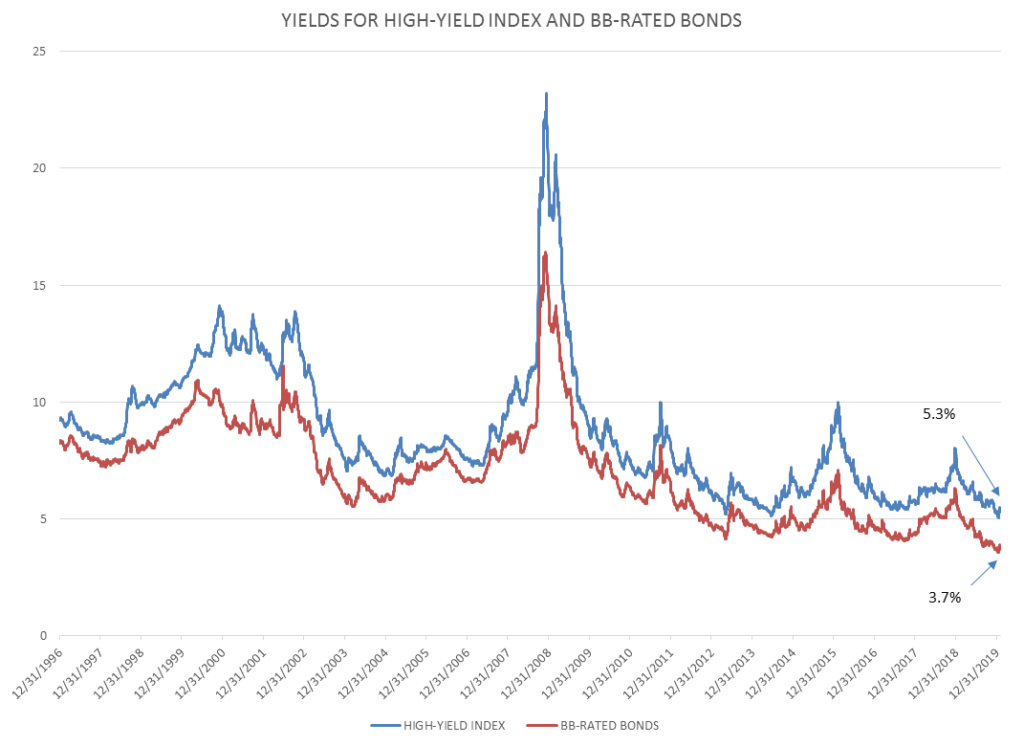

The chart above shows the yields for a high-yield index and the higher-quality BB-rated segment of that index. The high-yield index has been yielding 5.02%, while BB-rated bonds have been yielding 3.67%; both have been trading at or near historically low levels. Therefore, investors have been accepting lower-quality exposure in order to get the 5% index yield. While we are not calling for an imminent decline in high-yield bonds, we are cautious of valuations and reluctant to go too far down in quality at this point in the cycle.

Where Else to Find Yield?

A key question today is how to generate income without taking on too much credit or duration risk. We believe this could be achieved by selectively taking risk, keeping part of credit and equity exposures in higher-quality and liquid areas of the market to take advantage of volatility, and opportunistically investing in fundamentally sound securities at more attractive valuations.

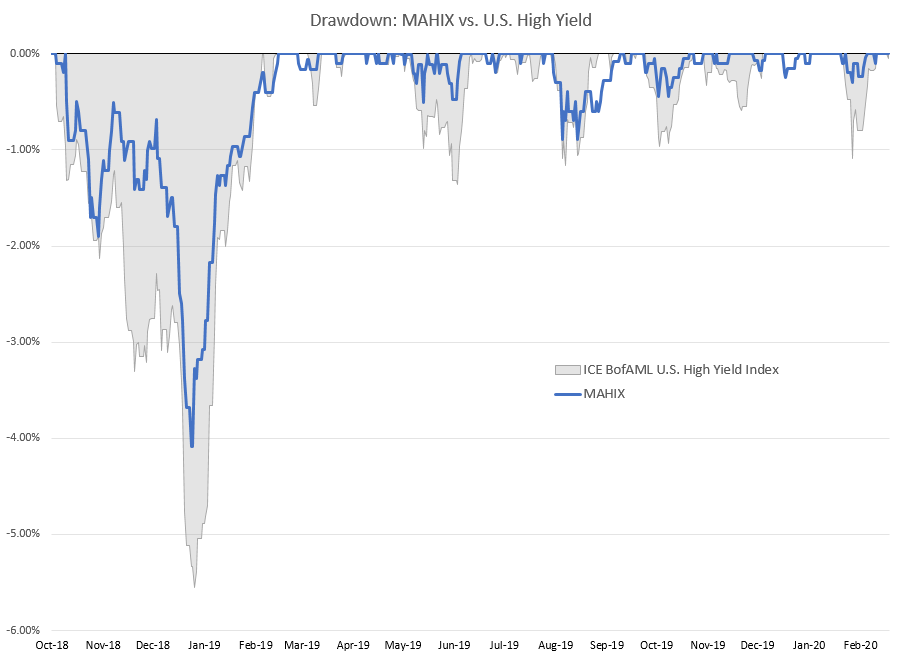

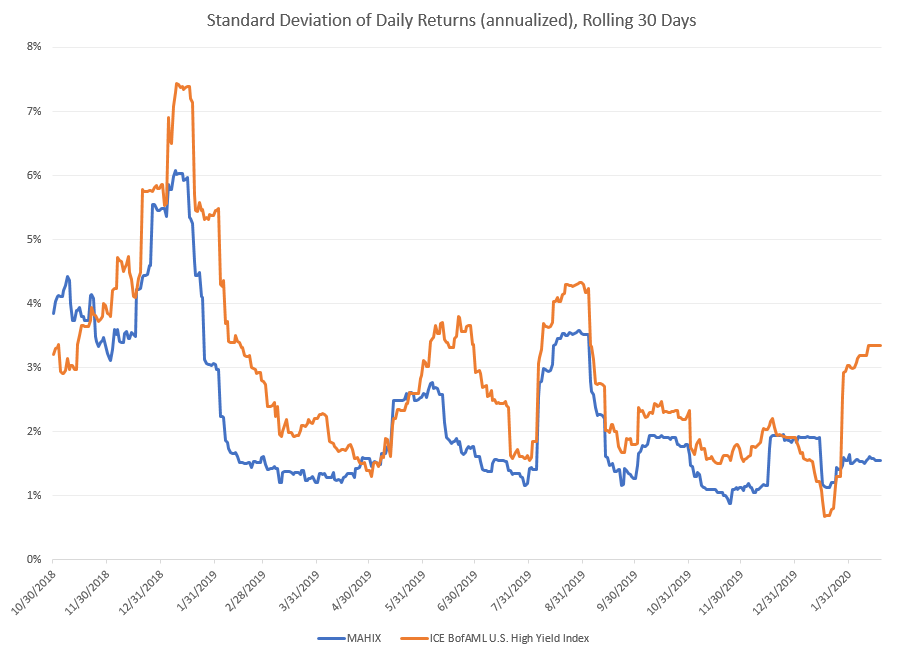

The charts below illustrate that our Litman Gregory Masters High Income Alternatives Fund (video overview here) has demonstrated less downside and less volatility than high-yield. It is our belief that this risk profile will persist, and returns will be competitive with high-yield over a cycle.

The Litman Gregory Masters High Income Alternatives Fund [MAHIX, MAHNX]

The fund is sub-advised by skilled, experienced managers executing differentiated income-oriented strategies focused on non-traditional and/or less efficient market areas. The fund seeks to generate high current income relative to the Bloomberg Barclays Aggregate U.S. Bond Index, with volatility that is typically less than high-yield bond indexes.

We have designed the fund to provide each manager with a high degree of flexibility to implement their strategies. The multi-manager structure allows each sub-advisor to take full advantage of compelling opportunities in their pursuit of high income, while achieving broad diversification at the overall fund level.

- Access to alternative sources of income that investors may not otherwise own

- Seeks high level of income without taking unnecessary risk or reaching for yield

- Leverages Litman Gregory’s expertise investing in income-generating strategies beyond traditional core fixed-income

- Leverages Litman Gregory’s access to top-tier investment managers

The fund’s role in a portfolio is best viewed as a complement to traditional fixed-income allocations, seeking a goal of returns significantly higher than core fixed income with low correlation and less interest rate sensitivity, but higher volatility.* The fund can serve as part of an investor’s diversified fixed-income allocation, or as part of an alternative strategies allocation.

Learn more about the Litman Gregory Masters High Income Alternatives Fund.