The iMGP Oldfield International Value Fund returned 20.58% during the fourth quarter of 2022, outperforming its benchmark MSCI EAFE Value Index (up 19.64%), as well as the MSCI EAFE Index (gain of 17.34%). The Morningstar’s Foreign Large Value Fund peer group returned 18.09%. For the full year, the fund fell 14.89% compared to losses of 5.58% and 9.15% for the MSCI EAFE Value Index and Morningstar Foreign Large Value category, respectively.

Since its inception November 30, 2020, the fund has gained 1.02% annualized, trailing its value benchmark and peer group, which have gained 4.38% and 3.23% annualized, respectively. The MSCI EAFE Index has fallen 0.19% annualized over the same period.

Performance quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the funds may be lower or higher than the performance quoted. Short term performance is not a good indication of the fund’s future performance and should not be the sole basis for investing in the fund.To obtain standardized performance of the funds, and performance as of the most recently completed calendar month, please visit www.imgpfunds.com.There are contractual fee waivers in effect through 4/30/2023.

Quarterly Portfolio Manager Commentary

At the core of our investment approach is classic, contrarian, bottom-up, Value investing. For more than a decade through the end of 2021, the Value style of investing has lagged in a world of Quantitative Easing (QE) and ultra-low interest rates where the cost of capital was distorted and investors chased growth irrespective of valuation and often common sense. 2022 will go down as the year of ‘regime change’ where the received wisdom, built up in a world of QE, started to crumble.

We think that this change in market regime is fundamental, and we look forward to many more years of the resurgence in Value. If Value and Growth areas of the market are to resume their historical relationship, there remains significant return potential for Value from our style of investing and from our international equity strategy.

In December, the fund fell 0.56% versus a gain of 0.08% for the MSCI EAFE index. For the fourth quarter, the fund delivered a return of 20.58% versus 17.34% for the MSCI EAFE index and 19.64% for MSCI EAFE Value. This means for the year the fund fell by 14.89% versus losses of 14.45% for the MSCI EAFE and 5.58% for MSCI EAFE Value index.

Since Putin’s invasion of Ukraine on February 24th, 2022, the Fund’s relative performance has suffered. For the 12-month period ending January 2022, the Fund was up 17%, comparing favorably to MSCI EAFE Value’s gain of 12.93% and MSCI EAFE’s return of 7.0%. We are obviously very disappointed that the Fund has suffered so significantly in the seven-month period between the invasion of Ukraine and the end of September but cheered that the Fund kept pace with the strong recovery in international markets in the final quarter of the year. We believe that the fund will recover from this set back and note that by our analysis the weighted average upside of the stocks in the Fund is exceptionally attractive at over 50%.

With the invasion of Ukraine, Europe was seen as the epicenter of geopolitical risk and global investors fled the region, which negatively impacted our performance in the second and third quarters. The UK investments suffered additionally by a self-induced crisis with Prime Minister Liz Truss’s mini budget in the Autumn which negatively impacted on Sterling, UK bonds and domestically exposed equities. This hit the share prices of both domestic (BT, Tesco, Lloyds) and dollar cost (easyJet) companies. Our exposure to the UK accounted for some 70% of the underperformance versus MSCI EAFE Value for the year. With the departure of Liz Truss and arrival of Rishi Sunak as Prime Minister, we have seen a marked stabilization in the UK bond market and the currency, but we think that the domestically exposed areas of the UK equity market remain substantially undervalued with their falls significantly overdoing any impact on their operating fundamentals.

Our worst performer in the Fund for the year was easyJet, the UK and European low-cost airline. 2022 was a poor year for airlines but especially for easyJet. The recovery in air travel is coming through following the curtailments seen during the pandemic. However, easyJet suffered because its airports failed to restore operations fast enough to meet demand, leading to travel chaos and cancelled flights. At the same time, we witnessed a rising cost of jet fuel and increasing concerns around consumer discretionary spend in 2023. One of the attractions of easyJet was that it operates from these capacity constrained, primary airports. With limited spare capacity at these airports, easyJet is largely competing against the legacy flag carrier airlines. The competitive cost advantage easyJet has against these has only increased over time and is enhanced during industry downturns, as in the pandemic. Many of easyJet’s competitors are now in financial distress and facing significant cost inflation having had to succumb to aircrew wage demands after taking state aid. The operating issues at airports have been largely resolved and even in a weakening consumer environment easyJet should demonstrate significant profit recovery from here. In a sector that is meaningful to the transition to net zero, easyJet appears to be a leader in the detail and commitment of their strategy. It has a strong balance sheet and good fleet optionality over the coming years—as it takes on new, more fuel-efficient planes further increasing its competitive advantage. This has not been reflected in the share price which is down 42% over the year (in local currency) and remains below the pandemic low in March 2020. The market value of easyJet is currently at c.£2.5bn which is roughly half that pre-pandemic. However, forecast Earnings Before Interest, Taxes, Depreciation and Amortization (“ EBITDA”) for 2023 (just taking the market consensus) is the same as that achieved in 2019 and significantly higher in the subsequent years. The upside to our target valuation is currently the highest in the portfolio and stands at a multiple of the current share price.

BT, the incumbent telecom operator in the UK, was the second largest faller for the year but the largest detractor to fund performance in the year given its larger weighting in the Fund. The shares fell ‑30% in local currency, but ‑38% in US dollars. The UK’s seemingly self‑induced ‘Gilt scare’ led to a liquidity crisis for many mature UK pension funds and BT’s £47bn pension fund was no exception. The scheme warned that it may need ‘support’ from the company, which spooked investors. However, liquidity has returned to the Gilt market, investors calmed and at this stage we see no material changes to our outlook for BT’s cash flows. We also note the potential positive impact on deficit funding from the higher discount rates. The operating fundamentals for the business remain intact. In November we met with BT’s CEO, Philip Jansen. He, like us, is bullish on the medium-term prospects for the company. BT’s build rate for fiber to the home is impressive and Jansen explained that their operating efficiency and higher-than-expected take-up of the new fiber offerings suggested that returns on fiber investment will exceed his prior expectation. BT’s fixed line network division, Openreach, is actively consulting with its customers (such as Sky, TalkTalk and Vodafone) on a new wholesale pricing scheme that would effectively share these excess returns from the fiber build out with them and lock them in. The regulatory asset value for the Openreach business is £17 billion and yet the market capitalization for the whole of BT is less than £12 billion. We see fair value at around 275p a share, c.140% above the year end price. While we await the fair value, the shares offer a well-covered (over 2.5x) dividend yield of c.6.8% and trade on a forward price to earnings of less than 6x.

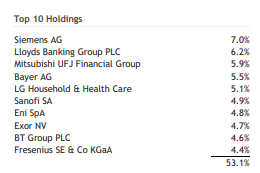

The Continental European companies we hold in the portfolio have solid fundamentals and have, in the most part, increased their long‑term earnings power through the year. For us this means the long‑term value remains intact and falls in their share prices have represented a buying opportunity. It is something we took advantage of in several cases during the year with timely additions to Siemens, Sanofi and Bayer.

The fund also suffered from its exposure to China and the country’s commitment to its zero-COVID policy that hurt the economy and our holdings in Alibaba and LG H&H. We believed that this policy was unsustainable and therefore would not be maintained. With the almost complete abandonment of COVID-related restrictions in China in November, we saw recoveries in the share prices of these companies of more than 50% each in the last two months of the year. From year-end levels, we see upside of around 50% for LG H&H and 170% for Alibaba.

A notable bright spot in 2022 was the exposure to Japan. The best performer and largest positive contributor to the Fund during the year was Mitsubishi Heavy Industries (MHI), a Japanese industrial conglomerate. MHI had been a deeply unfashionable investment in recent years. It suffered from the fall in demand for its gas turbine business and was hit hard in the pandemic given that it is a tier one supplier to Boeing and had to abandon its development of a regional jet. But in 2022 it benefitted from a reappraisal of its fortunes, as it remains the largest defense contractor in Japan and it is seen as a potential beneficiary of the World’s move to net zero carbon emissions. The shares rose +102%, in local currency terms in 2022. It had been the largest negative contributor to overall performance in 2021, with the share price down 13% and we had started 2022 buying more. Since the rapid advance in the shares during the year it has now reached our view of fair value and we have been using this share price strength to reduce our holding.

Another positive contributor in Japan was Mitsubishi UFJ Group (MUFG), our third best performer of the year. We often say that in Japan ‘out of necessity comes virtue’ and this has been the case with MUFG, the largest bank in Japan. In a world of negative interest rates their net interest income has been crushed, roughly halving over the last ten years. This has forced them to grow their international footprint in Southeast Asia (primarily Thailand and Indonesia), cut costs and return capital to shareholders via the dividend and share buy backs. But given the collapse in net interest income it has been an uphill battle. It could not prevent the decline in returns and a de‑rating from over 1.0x price to book value in 2009 to less than 0.5x. We saw ample opportunity to improve shareholder returns, given they held a stake in Morgan Stanley that at times equated to over 40% of their entire market value. They also had capital gains on cross shareholdings which they have been actively reducing.

In late 2021, they announced the disposal of their US retail operations to US Bancorp for $8bn, which was completed at the end of 2022. This deal frees up capital that MUFG can return to shareholders. Our investment thesis for MUFG has never relied on an improvement in the macroeconomic backdrop although any increase in net interest margins would create further upside. The surprise move at the end of the year by the Bank of Japan governor Haruhiko Kuroda to lift its target band on the ten year Government bond from 0.25% to 0.50% seems small but it is very significant in terms of macroeconomic backdrop and direction of travel. It signals the start of the end to MUFG’s long suffering battle against negative interest rates. The shares have re-rated positively but still trade on an attractive 0.65x price to book value.

In December we initiated a new position in CK Hutchison Holdings (CKH). This is a Hong Kong listed conglomerate controlled by the Li family, with a current market value of c.US$24 billion. We have followed this company for many years. We have watched from the side-lines, as the share price has fallen from a peak of over HK$120 in 2015 (with the merger of Hutchison Whampoa and Cheung Kong) to a low of $40 in November of 2022.

There is much on the face of it to deter global investors from CKH given its complexity, the uncertainty around Hong Kong’s future and the role of the controlling interests. But we believe that CKH is a collection of highly attractive assets (mostly European) on which the current discount has never been greater. CKH owns both majority and minority stakes in listed and unlisted businesses across five main industries: Retail, Ports, Infrastructure, Telecoms and Energy. It owns 75% of Watson, the world’s largest health and beauty retailer. It is one of the largest operators of ports globally. It is in telecoms, principally through the 3 Group in Europe but also in Asia. It has an infrastructure business in power generation, water and waste management and in Energy via its 16% stake in the Canadian-listed oil & gas company, Cenovus. The market valuation for the group equated to just the listed assets which account for some 40% of our gross asset value. This means that the value being attributed to its unlisted assets has turned negative for the first time (this includes some of its largest businesses in Retail, Ports and the 3 Group).

The historically high discount to our sum of the parts is attractive but what makes this a compelling investment is recent moves to create shareholder value. CKH has shown that it is not wedded to retaining ownership of these assets if it can create value for shareholders and it is engaging in significant portfolio restructuring. They are addressing the weakest part of their portfolio in the European telecoms space with the proposed merger of their UK assets with Vodafone’s for a minority stake in the combined UK business. We are receiving a 6% dividend yield and they are also buying back shares. CKH trades on a forward price to earnings ratio of just 5x, 5x Enterprise Value (“EV”)/EBITDA and 0.3x price to. This is too cheap for a diversified group of relatively high quality and defensive businesses. One our conservative forecasts we see over 50% upside and a highly attractive total return of c.19% per annum.

In the month we also bought Henkel, the German based households products and chemicals company. It has three major divisions: Laundry and Home Care (35% of sales; with key brands Persil, Purex, Dixan and Sun), Beauty (20%; with key brands Schwarzkopf, Dial and Fa) and Adhesives (45%; key brands Loctite, Teroson and Pattex). Its biggest markets are Western Europe (30% of sales) and North America (27%). Henkel generates 40% of its sales from emerging markets.

Henkel is the global leader in industrial adhesives and this business has very attractive fundamentals. Adhesives represent a tiny part of the finished product but are often ‘mission critical’, together giving it strong pricing power. There is also a secular trend of growth here for industrial uses. One such area of growth is in autos, where demand from this industry accounts for around 20% of Henkel’s adhesive business. In the move to battery electric vehicles, it is estimated that Henkel’s content per car will nearly triple. We became very interested in Henkel at the start of the year, as the share price had fallen by 44% from its peak in 2017 after a series of profit warnings given underinvestment in some of its consumer brands (which flattered the sustainable operating margin) and concerns around raw material price increases in the consumer business. This effect on the share price was compounded in the year with the general malaise towards the German equity market. Market forecasts have now become more realistic and the quality of the Adhesives business can be seen with organic growth in the first nine months of the year coming in at c.14% (driven largely by price). The company has a strong balance sheet and therefore low financial risk. The company has been de‑rated from 16x EV/EBITDA at the peak to around 8x today, with its historic median over the last 10 years being 12x. We have been conservative in our outlook but still see our investment in Henkel delivering a low‑risk c.15% return per annum from here which we think is attractive in the current market.

To fund these purchases, we used some of the cash we had in the portfolio and decided to sell the two smallest holdings in the portfolio in Nomura and Porsche. Whilst both had upside to our target valuations, our conviction in these holdings has diminished in recent months. Nomura has demonstrated poor fundamental performance for too long and the much hoped for transition to a more valuable advisory business has failed to materialise. We have been patient here, holding the shares for over 5 years and conducting deep due diligence with senior and operational management throughout. However, for a business that should have been geared to rising stock markets through until the end of 2021, the fundamental and stock price performance has been poor. Porsche SE has many attractions and was a much more recent purchase. The IPO of Porsche AG was a success in difficult markets and achieved a valuation of around 20x price to earnings for the luxury car business. However, we are increasingly concerned about the outlook for a business that relies heavily on sales to China. The VW Group (part owned by Porsche SE) is delivering historically high operating margins which we believe are not sustainable given the growing headwinds and longer‑term industry outlook.

It is hard to stand apart from the crowd, particularly when performance is disappointing. It is this which ultimately underpins the long‑term outperformance of Value over many previous decades. The duration of the relative drawdown in Value has been unprecedented and this created all manner of pressures on investors. Our culture and philosophical commitment to Value investing remains consistent. At the end of the year the portfolio had a weighted average upside of over 50% which remains high and attractive by historic standards. Our companies remain lowly valued with the overall portfolio on a forward price to earnings ratio of less than 9x on a weighted average basis, with strong fundamentals which gives us confidence that we have the potential to generate attractive long-term returns over the coming years.