In this Q&A, Litman Gregory Senior Research Analyst Rajat Jain discusses the iMGP Oldfield International Value Fund, a contrarian value strategy managed by Oldfield Partners. The fund will launch on November 30, 2020.

Why did we create this fund?

The iMGP mission is to find skilled managers running distinctive strategies in asset classes we consider less efficient and therefore well suited for active management. Oldfield Partners has a 20-year history of value investing around the globe. The investment team carries an impressive pedigree that began with Richard Oldfield that is carried forward by a team and culture that we consider exceptional.

The International Value strategy is led by Nigel Waller and Andrew Goodwin, two skilled portfolio managers with a strong commitment to shareholders. The process draws on intensive research and decades of experience of 12 global generalists that are value-minded independent thinkers who in their execution we believe exhibit exceptional investment discipline.

Oldfield exemplifies the iMGP mission in the approach they take in building a portfolio of 25 to 30 of their highest-conviction ideas. They are classic value investors who possess the discipline and clarity of process to stay true to their roots, which is critical to our high conviction. We like that they are high active share because outperformance requires the willingness to look very different than the benchmark . And while finding managers we believe are great is non-negotiable, we also want strategies unavailable elsewhere (this is the only fund with Oldfield’s International Value strategy).

Why is this a good time to launch this fund?

There are two very strong trends that we believe could make this a good time to own iMGP Oldfield International Value: the lengthy cyclical underperformance of foreign stocks relative to U.S. stocks, and the similarly lengthy trend in which value has massively underperformed growth. Both these trends are at historic extremes, and in the past across many cycles these trends have always reversed after reaching extremes.

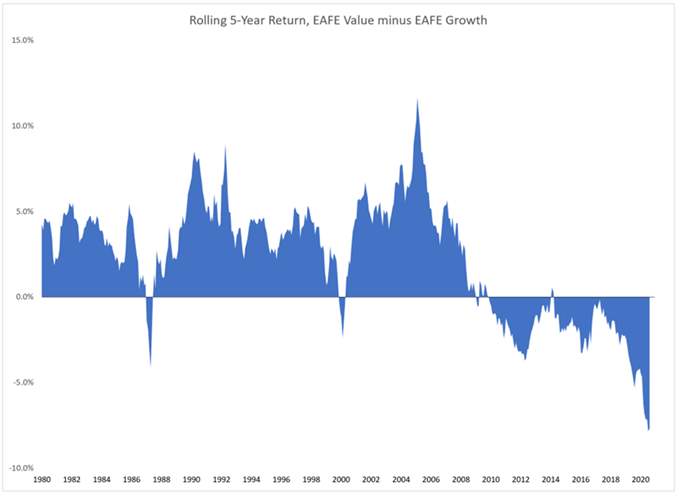

Foreign stocks have underperformed U.S. stocks by 9.1% annualized the past ten years ending September 30, 2020. In addition, value has underperformed growth, as represented by the MSCI EAFE Value Index and the MSCI EAFE Growth Index, respectively, by 4.9%, annualized. The underperformance has gone on so long that anecdotally we see investors giving up on value and chasing growth regardless of their valuations. This is strongly reminiscent of the 1999/2000 tech bubble.

Value underperformance this cycle has been historic in part because we have been in a regime of very low real interest rates leading investors to flock toward stable (quality) and long-duration growth stocks. But low rates do not equal infinity or any price. Chart below.

What makes this fund distinct from others in the category?

Several qualities set Oldfield Partners apart and contribute to our very high confidence. Oldfield Partners is a contrarian value shop searching for bargains, which means they have a propensity to look at things other investors are uncomfortable committing capital to. The sentiment for some of these stocks is so poor that their prices are beaten down excessively. This may create an alpha-generating opportunity.

To practice this style of investing successfully over the long term as they have, we believe you need to have a value-oriented mindset, of course. In addition, you need to think independently, have a supportive team culture that encourages patience, and maintaining a long-term horizon. These attributes have been built into Oldfield Partners’ culture by the founders, Richard Oldfield and Nigel Waller, in part through their hiring process. In addition, the team overall is highly experienced (the two Portfolio Managers average 28 years and the overall investment team 20 years) and comes from diverse backgrounds allowing multiple perspectives to be reflected when ideas are discussed and debated. This helps the team be highly selective. And we believe the skill of this experienced team is rising cumulatively because the team is actively learning from its past mistakes and is incentivized to do well.

Finally, when it comes to stock picking, the team is highly disciplined in ensuring they have layers of conservatism built into their analysis. They also have a three-bite rule (more on that below) to minimize the impact of “value traps,” a risk that comes with this style of investing: They almost always sell when a stock price hits their price target: It can only be raised after extensive debate among the team. Last but not least, by focusing on only their highest-conviction ideas they ensure they are not diluting their efforts.

In sum, we believe Oldfield Partners is set up to execute this contrarian value strategy extremely well because we believe they are doing a lot of things better than most:

- Their patient and supportive culture

- Their experience and learning mindset

- Their exceptional buy and sell discipline

- Their focus on only their highest-conviction names

What are your expectations for fund performance?

Oldfield is committed to their goal of running a relatively small asset base, which could raise the odds of maintaining their edge longer term. Given the concentrated nature of their portfolio, investors will need to be prepared to weather shorter-term underperformance versus a broad benchmark and tracking error in order to see potential benefits from this strategy.

What is the proper benchmark for this fund?

The fund is targeted to give exposure to larger-cap international stocks (market caps of $10 billion or more). We do not expect Oldfield to traverse into emerging markets in a substantive manner. So we think the MSCI EAFE Value Index and the MSCI EAFE Index are appropriate benchmarks to measure their performance over a full market cycle.

What kind of companies and opportunities are the portfolio managers looking for?

Oldfield partners believe most investors focus too much on the short term, which leads to compelling opportunities for contrarian long-term investors. The Oldfield team is drawn to companies that have a cloud over them, which often leads their stocks to trade at unusually cheap valuations. Oldfield believes in concentrating in only their highest-conviction ideas. What’s held in the index is not a consideration when making an investment decision.

They would look at what’s cheap and analyzable, so they cover a broad investment opportunity set. They do not have a prescribed type of business model or quality definition for their investment opportunity set. They may invest and have invested in health care and technology stocks when they offer good value. As Nigel Waller puts it, “[Cheap] valuation is our guiding light.”

They are very much aware of (and debate) disruption risks, threat from China, etc., to businesses they are finding attractive. They analyze industry trends, how the company makes money, and what its future growth prospects are.

They are wary of taking on companies with financial leverage, especially if they are operationally geared. They limit exposure to such companies at the overall portfolio level, as a risk-control measure.

How is “value” determined?

Oldfield Partners build their own financial models two to three years out and do the work so they can support their assumptions and views in front of the team. They often use sum-of-the-parts valuation analysis to find “hidden values.” They triangulate using multiple valuation metrics—price-to-earnings ratio (P/E), price-to-sales, price-to-book, price-to-free cash flow (P/FCF), enterprise value to sales, enterprise value/earnings before interest, taxes, depreciation and amortization, etc. In our discussions, it is clear their valuation assumptions are conservative in both absolute and relative terms. They seek to build a margin of safety or cushion at the valuation level and in the “fundamental variable” (basically the E in P/E, CF in P/CF).

We found them very disciplined with their price targets in that they almost always sell when targets are reached. This is key to their valuation discipline. They regularly update the fundamental variable as it naturally compounds. There needs to be a strong justification behind increasing the valuation multiple decided upon at the time of purchase, and it can happen only after a healthy debate among the team.

How do managers manage risk in the portfolio?

We believe the International Value portfolio will be highly concentrated in 25 to 30 stocks. In such a concentrated portfolio the key risk management comes from buying out-of-favor, cheap companies in relation to their normalized fundamentals. Oldfield will have their share of mistakes but they try to limit their impact through their conservative approach to estimating a company’s intrinsic value. That’s the first line of defense. The second is their culture, which encourages debates and gives the team freedom to change their minds when facts change and/or their views evolve. The third defense is to limit purchases to no more than three times (three “bites of the apple”), with the second bite requiring increasing levels of due diligence and the third an independent review by another analyst not close to the story. A stock typically may have an initial weighting ranging from 3% to 5% at the time of purchase, and they cannot own more than 10% at cost. They aim to achieve broad diversification in terms of countries, sectors, going down to the business-level risk factors each company brings to the portfolio. Stock weightings are a function of upside potential and the team’s conviction in achieving that upside. So, a stock with more potential upside but where the team believes the range of outcomes can be wide could have a lower weighting than a stock with less upside but a narrower range of outcomes. Note, this is another layer of defense against being wrong.

Describe the due diligence process. How did you pick the managers?

We first met members of Oldfield Partners in fall 2015 at their London offices. We kept following the firm and over the past year our more in-depth work involved numerous due diligence meetings and video calls with most of the investment team, including many hours with the two portfolio managers of the International Value strategy.

The goal of our due diligence is to identify whether a manager has an edge. In Oldfield’s case, their edge is a function of many things we believe they do better than most of their peers.

First is the quality and experience of the People and the Culture they have cultivated over nearly two decades at Oldfield Partners. That culture is one of approaching an issue calmly, deliberatively, distancing oneself from the noise, to think independently, always making decisions with a long-term view and with objectivity. They strive to become better and learn from their mistakes by discussing them openly and thinking about them and applying lessons learned. In any due diligence we perform, we spend a lot of time on these elements because ultimately we are investing with people, relying on their good and well-reasoned judgments to invest on our shareholders’ behalf.

The second major focus of our due diligence is whether the team has an Investment Discipline that they execute through thick and thin. This part of the process is both quantitative and qualitative. We look at historical performance of relevant strategies (going back 20 years in Oldfield Partners’ case) and cut and slice it various ways to look at what may not be obvious at first glance: We review detailed holdings-based attribution analysis, look at performance of a distinct category of stocks over time (international stocks within a global portfolio in this case), discuss past winners and mistakes and lessons learned, and walk through their investment thesis on a number of purchase and sell decisions to gain confidence they are executing their investment process as stated and with a high level of rigor and thought. Our assessment of their investment discipline was based on conversations and meetings with analysts and portfolio managers and a paper trail that comprises old client commentaries, client seminar and conference transcripts, and detailed research team notes. So, we had a vast body of knowledge and data points to arrive at a judgment on how well they are executing their stated conservative and contrarian form of value investing.

There are a number of other elements we assessed that we believe form the team’s overall advantage: team dynamics and the depth of team vetting that allows for multiple perspectives to be reflected on an issue by a team of experienced generalists, succession planning and ownership structure, the incentive of people to work at Oldfield Partners, the firm’s commitment to limit capacity in their products to ensure their performance advantage is not diluted over time, etc.

Our due diligence gives us confidence that in Oldfield Partners we have an experienced generalist team of value-minded investors that perform extremely thorough analyses on companies before they purchase and sell them. They seek to stack the odds in their favor by building in layers of conservatism in the underlying assumptions they use to come up with price targets, focusing on what can be known with confidence. And they are very disciplined when they sell and are refreshing the portfolio with only their highest-conviction names.

What do you think the fund’s role is in a portfolio? Describe how it may be best allocated or paired.

We believe asset classes go in cycles and portfolios should be globally diversified. We also believe the international allocation should be balanced across investment styles—value and growth. We view Oldfield International Value as a primary active international value manager, balanced with a quality and/or growth-oriented international manager.

Please contact us if you’d like more information on the Oldfield International Value Fund.