Commentary

Alternative Strategies Fund Third Quarter 2020 Commentary

All five sub-advisors generated positive performance during the quarter, and three of the five are positive for the year. MORE

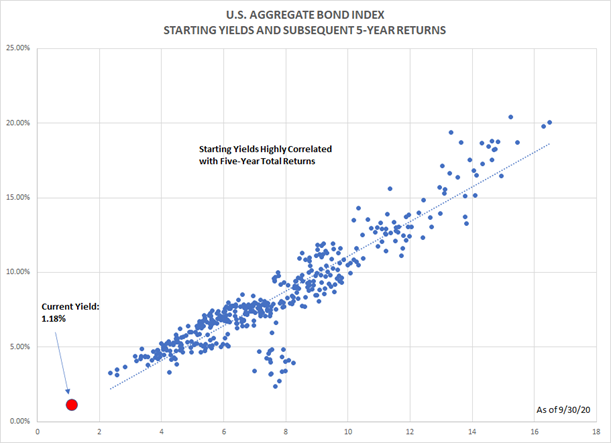

Core bond prices are at historic highs—or to borrow from last year’s widely circulated paper penned by AQR’s Cliff Asness, “frickin’ expensive.” In fact, bond yields are even lower today than they were in 2019, prior to the COVID crisis.

Not only do yields have little room to fall, offering very low current income (big problem #1), their sensitivity to rising rates is at an all-time high, resulting in minimal portfolio ballast in a crisis (big problem #2) thus presenting a suboptimal overall upside/downside return profile for portfolios (big problem #3).

Our conclusion at Litman Gregory: We’re diversifying core fixed-income allocations.

Our best idea: The iMGP Alternative Strategies Fund [MASFX, MASNX], a vehicle we built nine years ago with the goal of doing just that.

With a negative correlation to the Bloomberg Barclays U.S. Aggregate Bond Index (the Agg Index), a higher yield, and similar volatility metrics, alongside historical outperformance against that benchmark, we believe it makes for a strong core bond diversifier that can also generate satisfying returns.

The fund comprises five underlying separate-account strategies designed to provide both upside opportunity and diversifying ballast to portfolio construction, with unique sleeves from DoubleLine, Loomis Sayles, FPA, Water Island Capital, and DCI.

Please contact us if you’d like more information on the Alternative Strategies Fund.

All five sub-advisors generated positive performance during the quarter, and three of the five are positive for the year. MORE

iMGP Funds emails provide investors a way to stay in touch with us and receive information regarding the funds and investment principles in general. Topics may include updates on the funds and managers, further insights into our investment team’s processes, and commentary on various aspects of investing.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the funds may be lower or higher than the performance quoted. To obtain standardized performance of the funds, and performance as of the most recently completed calendar month, please visit www.imgpfunds.com. This material must be preceded or accompanied by a prospectus. Please read it carefully before investing. Mutual fund investing involves risk. Principal loss is possible. Past performance does not guarantee future results. The SBH Focused Small Value Fund is new and performance information is not available. Once performance is available, it may be obtained by calling 1-800-960-0188 or by visiting www.imgpfunds.com. Each fund may invest in foreign securities. Investing in foreign securities exposes investors to economic, political and market risks, and fluctuations in foreign currencies. The International Fund will invest in emerging markets. Investments in emerging market countries involve additional risks such as government dependence on a few industries or resources, government-imposed taxes on foreign investment or limits on the removal of capital from a country, unstable government and volatile markets. The Funds may invest in the securities of small companies. Small-company investing subjects investors to additional risks, including security price volatility and less liquidity than investing in larger companies. Investments in debt securities typically decrease when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in mortgage-backed securities include additional risks that investor should be aware of including credit risk, prepayment risk, possible illiquidity, and default, as well as increased susceptibility to adverse economic developments. Investments in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher-rated securities. Merger arbitrage investments risk loss if a proposed reorganization in which the fund invests is renegotiated or terminated. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management, and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. The funds may invest in master limited partnership units. Investing in MLP units may expose investors to additional liability and tax risks. The funds may make short sales of securities, which involves the risk that losses may exceed the original amount invested. Multi-investment management styles may lead to higher transaction expenses compared to single investment management styles. Outcomes depend on the skill of the sub-advisors and advisor and the allocation of assets amongst them. Leverage may cause the effect of an increase or decrease in the value of the portfolio securities to be magnified and the fund to be more volatile than if leverage was not used. Industry Terms and Definitions Index Definitions The Morningstar Rating for funds, or “star rating”, is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed products monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five, and 10-year (if applicable) Morningstar Rating metrics. The weights are 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10 year overall rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods. iMGP Alternative Strategies Fund was rated against the following numbers of Multialternative funds over the following time periods as of 9/30/2020: 247 funds in the last three years, and 192 funds in the last five years. With respect to these Multialternative funds, iMGP Alternative Strategies (MASFX) received a Morningstar Rating of 4 stars and 4 stars for the three- and five-year periods, respectively. Ratings for other share classes may be different. Morningstar rating is for the Institutional share class only; other classes may have different performance characteristics. The Investor share class received a rating of 3 stars and 4 stars for the three- and five-year periods, respectively.© 2020 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. Sharpe ratio is the measure of a fund’s return relative to its risk. The Sharpe ratio uses standard deviation to measure a fund’s risk-adjusted returns. The higher a fund’s Sharpe ratio, the better a fund’s returns have been relative to the risk it has taken on. Because it uses standard deviation, the Sharpe ratio can be used to compare risk-adjusted returns across all fund categories. The Fund’s Sharpe ratio ranked 2 out of 94 in its Peer Group, US OE Mulitalternative Morningstar Category from 10/1/2011 to 9/30/2020. Past performance is no guarantee of future results. References to other mutual funds should not be considered an offer of these securities. Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security Litman Gregory Fund Advisors, LLC has ultimate responsibility for the performance of the iMGP Funds due to its responsibility to oversee the funds’ investment managers and recommend their hiring, termination, and replacement. Effective July 31, 2020 the name of the Litman Gregory Masters Funds was changed to iMGP Funds. iMGP Funds are distributed by ALPS Distributors, Inc.